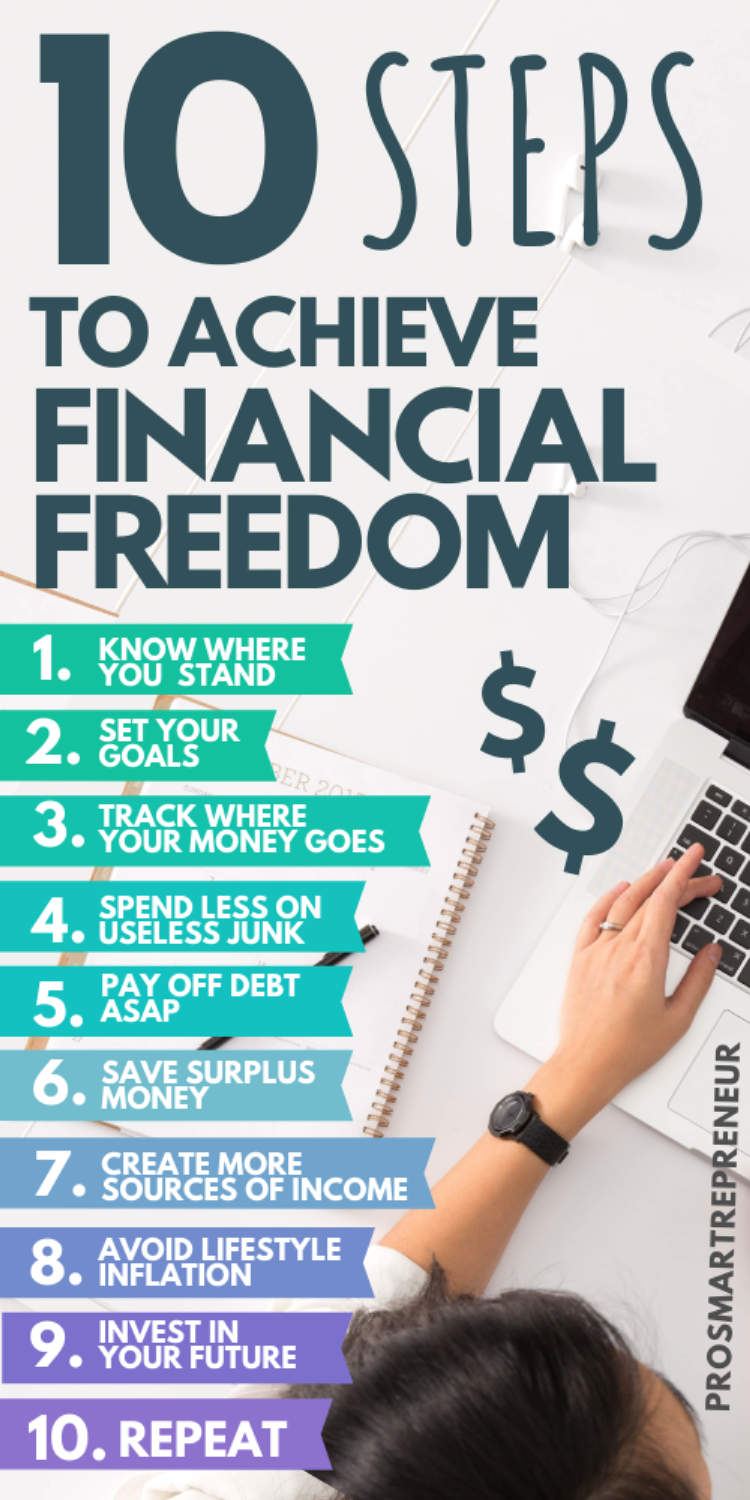

Financial independence is a goal that many aspire to achieve. It represents the freedom to make choices without being constrained by financial limitations. However, achieving financial independence requires careful planning and disciplined actions. In this article, we will discuss 10 steps that can pave your way towards financial independence.

The first step towards financial independence is setting clear financial goals. This involves defining what financial independence means to you and determining the amount of money you need to achieve it. By having a clear target in mind, you can better align your actions and make informed decisions regarding your finances. The next step is to create a budget and stick to it. A budget helps you track your income and expenses, identify areas where you can cut back, and ensure that you are saving enough to invest and grow your wealth.

Step 1: Setting Clear Financial Goals

Setting clear financial goals is crucial for achieving financial independence. Without a clear vision of what you want to achieve, it becomes difficult to make the necessary plans and actions to reach your financial goals. Here are some steps to help you set clear financial goals:

- Define Your Priorities: Take some time to reflect on what truly matters to you in life. Determine what your long-term aspirations are and what financial goals align with those aspirations.

- Be Specific: It’s important to be specific when setting financial goals. Rather than saying, “I want to save more money,” specify how much you want to save and by when. For example, “I want to save $10,000 in the next two years.”

- Set Realistic Goals: While it’s good to aim high, make sure your financial goals are attainable. Setting unrealistic goals may lead to frustration and disappointment. Consider factors like your current income, expenses, and time frame when setting your goals.

- Break It Down: Divide your financial goals into smaller, actionable steps. Breaking down big goals into smaller milestones makes them more manageable and allows you to track your progress more effectively.

- Make Your Goals Measurable: Establish specific metrics to measure your progress towards your financial goals. Whether it’s saving a certain percentage of your monthly income or paying off a specific amount of debt, having measurable goals will help you stay motivated and focused.

- Be Time-Bound: Assign a deadline to each of your financial goals. A time frame creates a sense of urgency and helps you prioritize your actions accordingly.

- Write It Down: Put your financial goals in writing. This simple act increases commitment and accountability. Keep your written goals in a place where you can review them regularly.

- Review and Adjust: Regularly review your financial goals and make adjustments as needed. Life circumstances may change, and it’s important to revise your goals accordingly.

By setting clear financial goals, you are taking the first step towards achieving financial independence. Remember to stay focused, track your progress, and celebrate your milestones along the way.

Step 2: Creating a Realistic Budget

When it comes to achieving financial independence, one of the most critical steps is creating a realistic budget. A budget is a financial plan that helps you track your income and expenses, allowing you to make informed decisions about how you spend and save your money. By creating a budget, you gain control over your finances and can work towards your financial goals. Here are some important considerations for creating a budget:

1. Assess Your Income and Expenses

Start by determining all your sources of income, such as your salary, side hustles, or investments. Then, list all your monthly expenses, including fixed costs like rent or mortgage payments, utilities, and insurance, as well as variable costs like groceries, entertainment, and transportation. This will give you a clear picture of your financial situation.

2. Differentiate Between Needs and Wants

Make a distinction between essential needs and discretionary wants. Allocate a portion of your budget towards necessary expenses like housing, groceries, and healthcare. Then, allocate a separate portion for discretionary spending, such as dining out, shopping, or vacations. Prioritizing needs over wants is crucial in maintaining a balanced budget.

3. Set Realistic Goals

Identify your financial goals, whether it’s saving for an emergency fund, paying off debt, or investing for retirement. Set realistic targets and incorporate them into your budget. By allocating a specific amount towards your goals each month, you can steadily work towards achieving them.

4. Track and Monitor Your Expenses

To ensure that you stay on track with your budget, it’s essential to track and monitor your expenses regularly. Use budgeting apps, spreadsheets, or financial tools to record your spending. This will help you identify areas where you may need to cut back or adjust your budget.

5. Make Adjustments as Needed

A budget is not a one-time thing; it needs to be reviewed and adjusted regularly. As your financial situation changes or unexpected expenses arise, be prepared to make necessary adjustments to your budget. Flexibility is key in ensuring that your budget remains realistic and effective.

By following these steps and creating a realistic budget, you are taking a significant stride towards achieving financial independence. A budget not only helps you manage your finances wisely but also enables you to build a solid foundation for a secure financial future.

Step 3: Building an Emergency Fund

An emergency fund is a crucial component in achieving financial independence. It is a reserve of money set aside specifically for unexpected expenses or emergencies. Without a sufficient emergency fund, a sudden job loss, medical emergency, or car repair could easily derail your financial progress. Here are some key steps to help you build a solid emergency fund:

1. Set a savings goal

Start by determining how much you want to save for your emergency fund. Ideally, you should aim to save at least three to six months’ worth of living expenses. This will provide a safety net to cover your essential costs in case of unforeseen events.

2. Create a budget

Building an emergency fund requires discipline and a clear understanding of your income and expenses. Take a close look at your monthly cash flow and identify areas where you can cut back on unnecessary spending. Allocate a portion of your income specifically for your emergency fund.

3. Automate your savings

Make it easier to save by setting up automatic transfers from your checking account to your emergency fund. By automating your savings, you remove the temptation to spend the money elsewhere and ensure consistent contributions to your fund.

4. Prioritize your fund

Make building your emergency fund a top priority. It should take precedence over other financial goals such as vacations or non-essential purchases. Treat your emergency fund as a financial safety net rather than a discretionary savings account.

5. Start small, but be consistent

If you’re struggling to save a significant amount right away, start small but stay consistent. Even saving a small amount each month will gradually build up your emergency fund over time. As your income increases, try to gradually increase your monthly contributions as well.

6. Keep the fund accessible

Ensure that your emergency fund is easily accessible when needed. Consider keeping it in a separate savings account that is not easily accessible for everyday spending, but still allows you to withdraw funds quickly without any penalties or fees.

7. Resist the temptation to use it

Remember, your emergency fund is not for discretionary spending. It should only be used for genuine emergencies that threaten your financial stability. Avoid dipping into your fund for non-essential purchases or expenses that can be covered through regular income.

By diligently following these steps, you can establish a strong emergency fund that provides you with peace of mind and financial security.

Step 4: Getting Rid of Debt

Debt can be a major obstacle on the path to financial independence. It is important to tackle this issue head-on and develop a plan to eliminate your debts. Here are some steps you can take to get rid of debt:

- Create a budget: Start by assessing your monthly income and expenses. Identify areas where you can cut back on spending and allocate more funds towards debt repayment.

- Prioritize your debts: List down all your debts and prioritize them based on interest rates and outstanding amounts. Focus on paying off high-interest debts first while making minimum payments on others.

- Set realistic goals: Determine a timeline for paying off each debt based on your budget. Break it down into smaller, achievable goals to stay motivated.

- Consolidate your debts: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This can make it easier to manage and pay off your debts.

- Explore debt settlement options: Contact your creditors to negotiate lower interest rates or repayment plans. Debt settlement can help reduce the overall amount you owe.

- Look for additional income sources: Consider taking on a part-time job or freelancing to boost your income. Use the extra money to accelerate your debt repayment efforts.

- Stay committed: Getting rid of debt requires discipline and persistence. Stay focused on your goals and avoid accumulating new debt while working towards financial independence.

By following these steps and remaining dedicated to your debt repayment plan, you can gradually eliminate your debts and move closer to achieving financial independence.

Step 5: Saving for Retirement

One of the most crucial steps towards achieving financial independence is saving for retirement. It’s important to start saving early and regularly to ensure a comfortable and secure future. Here are some tips to help you get started:

- Set clear retirement goals: Determine how much money you will need for a comfortable retirement based on your desired lifestyle and estimated expenses.

- Create a retirement savings plan: Develop a detailed plan outlining how much you need to save each month and the investment vehicles you will use.

- Maximize your employer’s retirement plan: Take full advantage of any employer-sponsored retirement plans such as a 401(k) or a pension plan. Contribute the maximum amount allowed and take advantage of any matching contributions.

- Open an individual retirement account (IRA): If your employer does not offer a retirement plan or you want to supplement your savings, consider opening an IRA. There are two types – traditional and Roth IRA – each with its own tax advantages.

- Manage your investments wisely: Diversify your retirement portfolio by investing in a mix of stocks, bonds, and other assets. Keep an eye on the performance and adjust your investments as needed to maximize returns.

- Stay disciplined and consistent: Make saving for retirement a habit. Set up automatic contributions to your retirement accounts and avoid dipping into those savings for non-retirement expenses.

- Take advantage of tax breaks: Become familiar with the tax benefits associated with retirement savings. For example, contributions made to a traditional IRA may be tax-deductible, reducing your taxable income.

- Consider consulting a financial advisor: If you feel overwhelmed or unsure about managing your retirement savings, seek assistance from a qualified financial advisor who can provide personalized advice based on your specific circumstances.

Saving for retirement requires discipline, commitment, and long-term planning. By following these steps and consistently saving, you’ll be well on your way to achieving financial independence and enjoying a worry-free retirement.

Step 6: Investing Wisely

Investing wisely is a crucial step towards achieving financial independence. By allocating your funds strategically and making informed investment decisions, you can grow your wealth over time. Here are some essential tips to help you invest wisely:

- Set financial goals: Before you start investing, it’s essential to define your financial goals. Whether it’s saving for retirement, buying a house, or funding your children’s education, having clear objectives will guide your investment strategy.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversification is key to managing risk. Spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities.

- Do thorough research: Before investing in any asset, do your homework. Study the market trends, analyze company financials, and understand the risks involved. The more knowledgeable you are, the better investment decisions you can make.

- Consider professional advice: If you’re unsure about making investment decisions on your own, it’s wise to seek professional advice. Financial advisors can provide expert guidance tailored to your needs and risk tolerance.

- Stay updated: The financial markets are dynamic, and staying informed is crucial. Keep track of economic news, industry trends, and market fluctuations. This will help you make timely adjustments to your investment strategy.

- Keep emotions in check: Investing can be emotionally challenging, especially during market downturns. Avoid making impulsive decisions driven by fear or greed. Stick to your investment plan and focus on long-term goals.

- Monitor and review: Regularly review your investments to ensure they align with your financial goals. Assess their performance, make adjustments if needed, and rebalance your portfolio periodically.

- Consider investment vehicles: Explore different investment vehicles, such as mutual funds, exchange-traded funds (ETFs), and Individual Retirement Accounts (IRAs). These can provide diversified exposure and tax benefits.

- Stay disciplined: Investing wisely requires discipline. Avoid chasing quick gains or succumbing to market hype. Stick to your investment strategy, contribute regularly, and have a long-term perspective.

- Seek continuous learning: The world of investing is ever-evolving. Stay curious and continue learning about different investment strategies, asset classes, and financial concepts. This will empower you to make informed decisions.

Step 7: Developing Multiple Streams of Income

In order to achieve financial independence, it is crucial to develop multiple streams of income. Relying solely on a single source of income can be risky and limit your earning potential. By diversifying your income streams, you create more opportunities to generate revenue and build wealth.

Here are some strategies to develop multiple streams of income:

- Start a side business: Consider starting a small business or freelancing in your spare time. This can provide additional income and also serve as a hobby or passion project.

- Invest in stocks or real estate: Investing in stocks or real estate can generate passive income through dividends, rental properties, or capital gains.

- Create and sell products or services: Use your skills and expertise to create products or provide services that can be sold online or offline.

- Monetize your hobbies: If you have a hobby or skill that others may find valuable, explore ways to monetize it. This can include teaching classes, offering consulting services, or selling handmade goods.

- Participate in affiliate marketing: Join affiliate programs and promote products or services through your website or social media platforms. You earn a commission for every sale or referral.

- Generate passive income through investments: Consider investing in dividend stocks, bonds, or rental properties that generate consistent income without requiring active involvement.

- Explore passive income opportunities: Look for opportunities to earn passive income, such as renting out a room on Airbnb or investing in a peer-to-peer lending platform.

- Collaborate with others: Partner with like-minded individuals or businesses to create joint ventures or collaborations that can generate additional income.

- Consider rental income: If you have space available, consider renting it out for extra income. This can include renting out a spare room, parking space, or storage area.

- Continue learning and growing: Stay updated with market trends and seek opportunities to acquire new skills or knowledge that can lead to additional income streams.

Remember, building multiple streams of income takes time and effort. Be willing to explore new opportunities, take calculated risks, and adapt to changes in the market. By diversifying your income sources, you increase your chances of achieving financial independence and creating long-term wealth.

Step 8: Protecting Your Assets

Once you have accumulated wealth and made significant progress towards financial independence, it is essential to take measures to protect your assets. Protecting your hard-earned money and investments can help ensure long-term financial security for you and your family. Here are some key strategies to consider:

1. Diversify Your Investments

One way to protect your assets is by diversifying your investment portfolio. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can reduce the risk of losing all your money in a single investment.

2. Consider Insurance Coverage

Having the right insurance coverage can offer a safety net for unexpected events that could otherwise wipe out your financial progress. Evaluate your needs and consider securing insurance for your health, life, home, auto, and other valuable possessions.

3. Create an Emergency Fund

Building an emergency fund is crucial to protect your assets from unforeseen circumstances such as job loss, medical emergencies, or major repairs. Aim to save enough money to cover at least six months of living expenses.

4. Estate Planning

Preparing an estate plan is essential to protect your assets and ensure they are distributed according to your wishes in the event of your passing. Consult with an attorney to create a comprehensive estate plan that includes a will, power of attorney, and healthcare directives.

5. Regularly Review and Update

Protecting your assets is an ongoing process. Regularly review and update your investment and insurance strategies to reflect changing circumstances in your life. Stay informed about market trends, policy changes, and new opportunities that may arise.

6. Seek Professional Advice

Consider engaging the services of a financial advisor or wealth manager who can provide expert guidance on asset protection. They can help you develop a personalized plan based on your financial goals, risk tolerance, and unique circumstances.

By implementing these asset protection strategies, you can safeguard your wealth and ensure a more secure financial future. Protecting your assets is vital to achieving and maintaining financial independence.

Step 9: Continuously Educating Yourself about Finance

One of the key factors in achieving financial independence is to continuously educate yourself about finance. By staying updated on financial trends, strategies, and concepts, you can make well-informed decisions and take control of your financial future. Here are some ways to educate yourself about finance:

1. Read Books and Articles

There are numerous books and articles available on personal finance and investing. Make it a habit to read at least one finance-related book or article every month. This will expand your knowledge and give you ideas on how to manage your money more effectively.

2. Follow Financial Blogs and Websites

Subscribe to reputable financial blogs and websites that provide valuable information and insights on personal finance. These platforms often cover a wide range of topics, from budgeting and saving to investing and retirement planning. Regularly reading these sources can help you stay updated with the latest trends and strategies.

3. Take Online Courses or Attend Workshops

Consider enrolling in online courses or attending workshops that focus on personal finance and investing. Many reputable organizations and educational platforms offer these courses, allowing you to learn from industry experts at your own pace. These courses often cover various topics, such as budgeting, investment strategies, and financial planning.

4. Join Financial Communities

Engaging with financial communities can provide you with opportunities to learn from others’ experiences and gain valuable insights. Join online forums or social media groups dedicated to personal finance. Participate in discussions, ask questions, and share your own knowledge. This interaction can help you expand your understanding of finance and gain different perspectives.

5. Attend Financial Seminars or Webinars

Keep an eye out for financial seminars or webinars happening in your area or online. These events often feature expert speakers who share their knowledge and experiences in various financial topics. Attending such events can provide you with practical tips and strategies to improve your financial well-being.

By continuously educating yourself about finance, you can enhance your financial literacy, make smarter financial decisions, and work towards achieving long-term financial independence.

Step 10: Tracking Your Progress and Making Adjustments

Tracking your progress and making necessary adjustments are crucial steps in achieving financial independence. By regularly monitoring your financial situation and making necessary changes, you can ensure that you stay on track towards your goals.

Here are some tips to help you track your progress and make adjustments:

- Review your financial goals: Take the time to reassess your financial goals and make sure they are still aligned with your long-term objectives.

- Monitor your income and expenses: Keep track of your income and expenses on a regular basis. This will help you identify areas where you can save more or reduce unnecessary spending.

- Update your budget: Adjust your budget as necessary based on your changing financial circumstances. This could include changes in income, expenses, or unexpected events.

- Check your investment portfolio: Regularly review your investment portfolio to ensure that it is performing as expected. Consider rebalancing your investments if needed to maintain your desired asset allocation.

- Track your debt: Keep tabs on your debt and consider strategies to pay off high-interest debts first. This will help you save money on interest payments and improve your financial situation.

- Seek professional advice: Consult with a financial advisor or planner to get expert guidance and personalized recommendations. They can help you analyze your financial progress and suggest adjustments.

Remember, financial independence is a journey, and it requires ongoing effort and attention. By tracking your progress and making necessary adjustments along the way, you can stay on the path towards achieving your financial goals.

Conclusion

Financial independence is a goal that many people strive to achieve. By following the 10 steps outlined in this article, you can take control of your finances and work towards becoming financially independent.

The first step is to create a budget and track your expenses. This will help you understand where your money is going and identify areas where you can cut back. Next, focus on paying off any high-interest debts, such as credit card balances or student loans. This will free up more of your income to save and invest.