Budgeting is an essential skill for managing your finances effectively. By tracking your expenses and saving money, you can achieve financial stability and reach your financial goals. In this article, we will explore five effective strategies for budget tracking and saving money that can help you take control of your finances and improve your financial well-being.

The first strategy is to create a budget plan. This involves carefully analyzing your income and expenses to determine how much you can allocate to different categories, such as housing, transportation, food, and entertainment. By setting realistic budget limits for each category, you can ensure that you are not overspending and prioritize your savings goals. Additionally, using budgeting apps or spreadsheets can help you track your expenses and monitor your progress.

Setting Clear Financial Goals

Having clear financial goals is essential for effectively managing your budget and saving money. By setting specific and attainable goals, you can stay motivated and focused on your financial objectives. Here are some strategies to help you set clear financial goals:

- Identify your priorities: Start by determining what matters most to you financially. Do you want to pay off debt, save for a down payment on a house, or build an emergency fund? Prioritizing your goals will help you allocate your resources effectively.

- Make your goals SMART: Use the SMART criteria – Specific, Measurable, Achievable, Relevant, and Time-bound – to make your financial goals more precise and actionable. For example, instead of saying, “I want to save money,” set a specific amount and a timeframe, like “I want to save $5,000 for a vacation in two years.”

- Break down your goals: Large financial goals can seem overwhelming at first. Break them down into smaller, manageable milestones that you can work towards. This will give you a sense of progress and keep you motivated along the way.

- Create a budget: A budget is a crucial tool for achieving your financial goals. It helps you track your income, expenses, and savings. By creating a budget, you can see where your money is going and make adjustments to align with your goals.

- Regularly review and adjust: Financial goals may change over time, and it’s important to review and adjust them periodically. Life circumstances and priorities can shift, and your goals should reflect those changes.

By setting clear financial goals, you can take control of your finances and make informed decisions to achieve them. Remember to stay disciplined, track your progress, and celebrate milestones along the way.

2. Creating a Budget Plan

Creating a budget plan is an essential step in effectively managing your finances. By having a clear budget in place, you can track your expenses, prioritize your spending, and save money for the future. Here are some strategies to help you create an effective budget plan:

Set Clear Financial Goals

The first step in creating a budget plan is to determine your financial goals. Whether you want to pay off debt, save for a vacation, or build an emergency fund, setting clear goals will give you a sense of purpose and motivation.

Calculate Your Income and Expenses

To create an accurate budget plan, you need to calculate your monthly income and expenses. Start by listing all your sources of income, including your salary, side hustles, and any other sources. Then, track your monthly expenses, including groceries, bills, transportation, entertainment, and other discretionary spending.

Categorize Your Expenses

After calculating your expenses, categorize them into essential and non-essential expenses. Essential expenses include rent/mortgage, utilities, groceries, and transportation, while non-essential expenses refer to discretionary spending such as eating out, shopping, and entertainment.

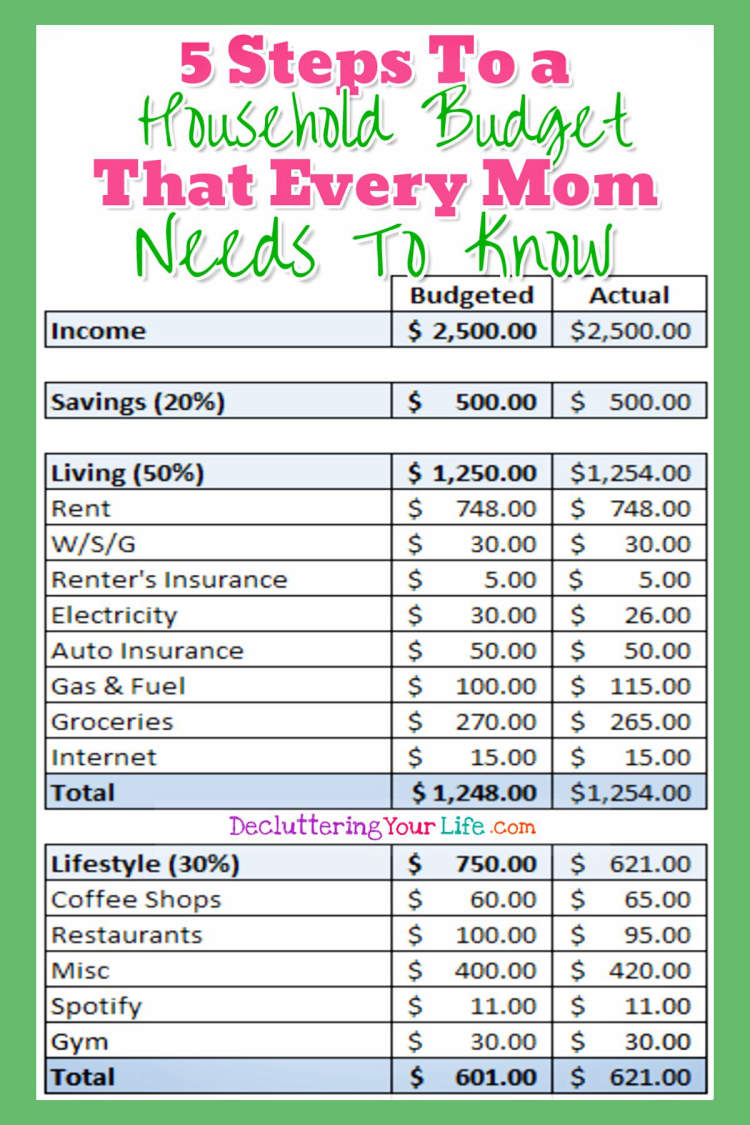

Create a Budget Spreadsheet

Using a budget spreadsheet can help you organize and monitor your income and expenses. There are various spreadsheet templates available online that you can customize according to your needs. Be sure to allocate funds for each expense category based on your financial goals and prioritize your spending accordingly.

Track and Adjust

Once you have created your budget plan, it’s important to track your expenses regularly. Keep all your receipts and record your spending to compare them with your budget. This will help you identify any areas where you might be overspending and make adjustments as needed.

Review and Reassess

Regularly review your budget plan and reassess your financial goals. Life circumstances and priorities can change, so it’s important to ensure your budget plan is aligned with your current needs and aspirations. Make any necessary adjustments to your budget to stay on track.

By following these strategies and creating a budget plan, you can take control of your finances, track your spending, and save money for the future. Remember, consistency and discipline are key to achieving your financial goals.

Tracking Expenses and Savings

Managing your expenses and saving money can be a daunting task, but with proper budget tracking strategies, you can achieve your financial goals. Here are five effective strategies to help you track your expenses and save money:

1. Create a Budget

The first step in tracking your expenses and saving money is to create a budget. Start by listing all your sources of income and fixed expenses. Then, allocate a portion of your income to essentials, such as rent, utilities, and food. Determine how much you want to save each month and set aside that amount as well. Having a budget in place will help you stay organized and accountable for your spending.

2. Track Your Expenses

To effectively track your expenses, keep a record of every single purchase you make. This can be done using smartphone apps, spreadsheets, or even a pen and notebook. Categorize your expenses, such as groceries, transportation, entertainment, and so on. By keeping track of your spending, you will be able to identify areas where you can cut back and save more money.

3. Use Technology to Your Advantage

Take advantage of technology to simplify your budget tracking process. There are numerous apps and online tools available that can help you monitor your expenses and savings effortlessly. These tools can provide detailed reports, graphs, and even send you notifications when you exceed your budget in a specific category. Utilizing technology will make budget tracking more convenient and accessible.

4. Set Realistic Goals

When it comes to saving money, it’s essential to set realistic goals. Start by identifying your short-term and long-term financial objectives. Whether it’s saving for a vacation, a down payment on a house, or retirement, break down these goals into smaller, achievable targets. By setting realistic goals, you will stay motivated and focused on tracking your expenses and saving money.

5. Review and Adjust Regularly

Regularly reviewing your budget and expense tracking is crucial for successful financial management. Set aside time each month to analyze your spending patterns and adjust your budget accordingly. If you notice any areas where you consistently overspend, find ways to cut back in those areas. Additionally, celebrate your achievements when you hit your savings milestones to stay motivated on your financial journey.

By implementing these five effective strategies for budget tracking and saving money, you will gain control over your finances and reach your financial goals. Remember, tracking your expenses and saving money is a continuous process that requires discipline and planning. With consistency and determination, financial success is within your reach.

Conclusion

In conclusion, effective budget tracking and saving money requires careful planning and discipline. By implementing the following strategies, individuals can take control of their finances and work towards achieving their financial goals.

Firstly, creating a detailed budget is essential. This involves analyzing monthly income and expenses, categorizing them, and setting realistic limits for each category. Regularly tracking expenses and making adjustments accordingly will help to identify unnecessary spending and prioritize essential expenses.