Inflation is a critical economic concept that affects every aspect of our lives, from the prices we pay for groceries to the interest rates on our loans. Understanding inflation is crucial for managing our finances and making informed decisions. In this article, we will explore the causes, effects, and most importantly, how you can protect your finances from its negative impacts.

Firstly, let’s start by defining inflation. In simple terms, inflation refers to the sustained increase in the general price level of goods and services in an economy over time. While some level of inflation is considered normal and even healthy for an economy, too much or too little can have significant consequences. High inflation erodes the purchasing power of your money, while low inflation may indicate a sluggish economy. These effects can have serious implications for your personal finances, making it crucial to understand the causes behind inflation and how you can safeguard your wealth.

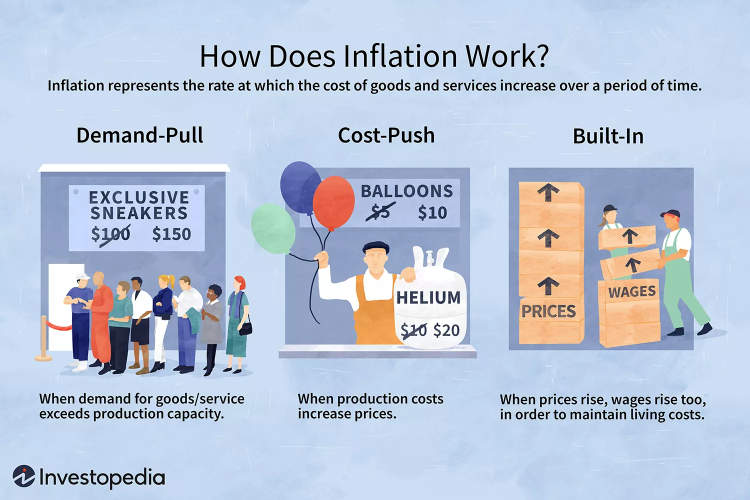

Causes of Inflation

Inflation refers to the overall increase in prices of goods and services in an economy over a period of time. There are several factors that contribute to inflation, including:

- 1. Demand-Pull Inflation: This occurs when the demand for goods and services exceeds their supply. When consumers have more disposable income and are willing to spend, businesses increase prices to maximize their profits. This leads to an increase in the general price level.

- 2. Cost-Push Inflation: This type of inflation occurs when the cost of production increases, leading to higher prices for the end products. Factors such as increased wages, rising raw material costs, and higher taxes can contribute to cost-push inflation.

- 3. Monetary Inflation: When there is excessive growth in the money supply of a country, it can result in inflation. This can happen due to factors such as the printing of more money by the central bank or an increase in the supply of credit and loans.

- 4. Exchange Rate Inflation: Fluctuations in the exchange rate can affect the prices of imported goods. If the domestic currency depreciates in value, imported goods become more expensive, leading to inflation.

- 5. Government Policies: Government policies, such as excessive borrowing and spending, can lead to inflation. If a government consistently runs large budget deficits, it may have to print more money or borrow from the central bank, increasing the money supply and causing inflation.

Understanding the causes of inflation is crucial for individuals to protect their finances and make informed decisions. By keeping an eye on these factors, individuals can adjust their spending, investments, and savings strategies accordingly. Additionally, understanding inflation helps in developing policies that can mitigate its negative effects and maintain a stable economy.

Effects of Inflation

Inflation is a phenomenon that occurs when there is a sustained increase in the general price level of goods and services in an economy over a period of time. This increase in prices has several effects on various aspects of the economy and people’s lives. Some of the key effects of inflation are:

- Reduced purchasing power: As the cost of goods and services increases, the value of money decreases. This leads to a decrease in purchasing power, meaning that people are able to buy fewer goods and services with the same amount of money.

- Decreased savings value: Inflation erodes the value of savings over time. If the interest earned on savings does not keep pace with inflation, the real value of savings decreases, impacting individuals’ ability to meet future financial goals.

- Higher cost of borrowing: Inflation often leads to an increase in interest rates set by banks and financial institutions. This makes borrowing money more expensive, affecting businesses and individuals looking to invest or make large purchases.

- Income redistribution: Inflation can have an unequal impact on different groups within society. Those on fixed incomes, such as retirees or individuals with low wages, may struggle to keep up with rising prices, leading to a redistribution of income from the poor to the rich.

- Uncertainty and instability: High inflation rates can create uncertainty in the economy, making it difficult for businesses and investors to plan for the future. This can lead to reduced investment and economic growth, causing instability in the overall economy.

Understanding the effects of inflation is crucial for individuals and policymakers alike. By being aware of these effects, individuals can take steps to safeguard their finances and mitigate the negative impact of inflation.

Protecting Your Finances from Inflation

Understanding Inflation: Causes, Effects, and How to Protect Your Finances

Inflation can have a significant impact on your finances. It occurs when the general level of prices for goods and services in an economy rises, eroding the purchasing power of your money over time. However, there are steps you can take to protect your finances from the effects of inflation:

- Invest in Real Assets: Real assets like real estate, gold, and commodities tend to hold their value or even increase during inflationary periods.

- Diversify Your Investments: Spreading your investments across different asset classes, such as stocks, bonds, and cash, can mitigate the impact of inflation on your portfolio.

- Consider Treasury Inflation-Protected Securities (TIPS): TIPS are bonds issued by the U.S. Treasury that provide protection against inflation. They adjust their principal value based on changes in the Consumer Price Index.

- Invest in Stocks: Historically, stocks have outperformed inflation over the long term. Companies can increase their prices and earnings to account for rising costs.

- Save and Invest Regularly: Consistently saving and investing a portion of your income can help you stay ahead of inflation. By growing your wealth over time, you can maintain your purchasing power.

- Review and Adjust Your Budget: Inflation affects the cost of everyday expenses, such as groceries and utilities. Regularly reviewing and adjusting your budget can help you identify areas where you can cut costs and save money.

- Monitor Interest Rates: Higher inflation often leads to higher interest rates. Monitoring interest rates can help you make informed decisions about borrowing and investing.

By taking proactive steps to protect your finances from inflation, you can safeguard your purchasing power and achieve your long-term financial goals.

Conclusion

Inflation can have significant consequences on an economy and individual finances alike. Understanding its causes and effects is crucial for protecting your financial well-being. In this article, we have explored the causes of inflation, including factors such as increased money supply, demand-pull inflation, and cost-push inflation.

We have also discussed the effects of inflation, such as diminished purchasing power, reduced real income, and eroded savings. It is important to be aware of these effects and take proactive measures to safeguard your finances. Strategies for protecting your finances from inflation include investing in assets that tend to appreciate over time, diversifying your investments, and considering inflation-indexed securities. Additionally, staying informed about economic indicators and monitoring inflation rates can help you make informed financial decisions.