In today’s unpredictable world, it has become increasingly important for individuals to prioritize their financial stability. One key component of achieving this stability is the establishment of an emergency fund. An emergency fund acts as a safety net, providing individuals with a financial cushion in times of unexpected expenses or income disruption. This article will explore the importance of building an emergency fund and its role in safeguarding your financial well-being.

Life is full of uncertainties, and financial emergencies can arise at any moment. Whether it be a sudden medical expense, a car repair, or the loss of a job, having an emergency fund can help alleviate the stress and negative impact of these unexpected events. By setting aside a portion of your income into an emergency fund, you create a financial buffer that allows you to navigate through difficult times without relying on credit cards, loans, or draining your savings earmarked for other long-term goals.

The Benefits of Having an Emergency Fund

An emergency fund is an essential component of financial stability. It provides a safety net during unexpected circumstances and offers numerous benefits for individuals and families. Here are some key advantages of having an emergency fund:

1. Financial Security

Having an emergency fund establishes financial security by giving you peace of mind. It acts as a cushion in times of crisis, such as job loss, medical emergencies, or major home repairs. With a safety net, you can navigate unexpected expenses without resorting to debt or depleting your savings and investments.

2. Ability to Handle Unforeseen Expenses

Life is full of surprises, and many of them come with financial implications. An emergency fund enables you to handle unforeseen expenses like car repairs, sudden medical bills, or home maintenance issues. Instead of scrambling to find funds or relying on credit cards, you can dip into your emergency savings without any stress.

3. Avoiding Debt and Its Consequences

Without an emergency fund, unexpected expenses often lead to borrowing money through credit cards, loans, or other forms of debt. By having a dedicated fund, you can avoid taking on unnecessary debt and the associated interest payments. This helps you maintain a healthy credit score and financial well-being in the long run.

4. Flexibility and Freedom

With an emergency fund, you have the flexibility to make decisions without being constrained by financial constraints. Whether it’s taking advantage of an opportunity, pursuing a career change, or dealing with a personal crisis, having savings that cover several months’ worth of expenses provides the freedom to navigate life’s uncertainties with confidence.

5. Enhanced Financial Planning

An emergency fund complements your overall financial planning strategy. It allows you to focus on long-term financial goals such as retirement savings, investments, and education funds for children, knowing that you have a safety net to rely on for unexpected emergencies. This enables you to allocate your resources more efficiently and achieve greater financial stability.

Building an emergency fund requires discipline and commitment. Start by setting a goal for how much you want to save, and then make regular contributions to your fund. Over time, your emergency fund will grow, providing you with the financial security and peace of mind that comes with being prepared for the unexpected.

Tips for Building an Effective Emergency Fund

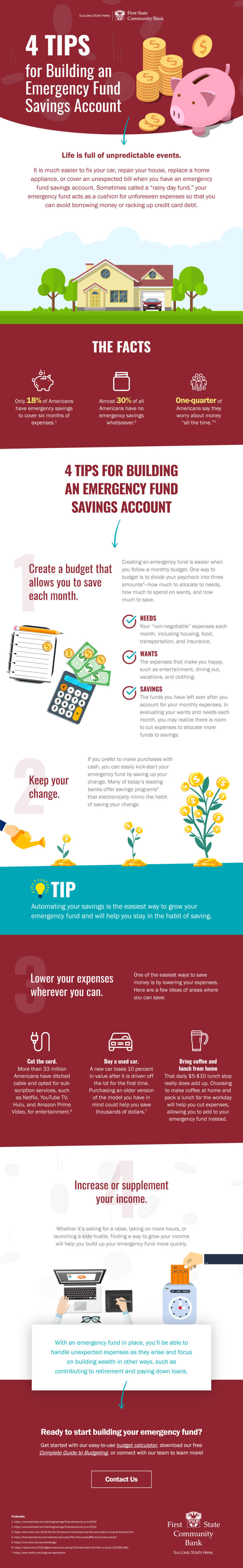

In today’s unpredictable world, it is crucial to have a financial safety net. Building an emergency fund is one of the best ways to safeguard your financial stability. Here are some valuable tips to help you build an effective emergency fund:

- Set a realistic savings goal: Start by determining how much you need to save for emergencies. Aim to save at least three to six months’ worth of living expenses.

- Create a budget: To build your emergency fund, it’s important to create a budget and track your expenses. Identify areas where you can cut back on unnecessary spending and allocate those savings to your emergency fund.

- Automate your savings: Make saving for emergencies a priority by setting up automated transfers from your checking account to your emergency fund. This ensures that a portion of your income goes directly into your fund without temptation to spend it elsewhere.

- Explore high-yield savings accounts: Look for savings accounts that offer higher interest rates. This will allow your emergency fund to grow faster, helping you achieve your savings goal sooner.

- Be disciplined: It’s important to stay committed to your savings goal. Avoid dipping into your emergency fund for non-emergencies, as it can hinder your progress and leave you vulnerable.

- Review and adjust: Regularly review your emergency fund goal and adjust it as needed. As your income, expenses, and life circumstances change, make sure your savings remain aligned with your needs.

By following these tips, you can build an effective emergency fund that will provide you with peace of mind during unexpected financial challenges. Remember, emergencies can happen to anyone, so it’s never too early to start saving!

How an Emergency Fund Can Protect Your Financial Stability

When it comes to managing your finances, building an emergency fund is one of the most important steps you can take to protect your financial stability. Having a contingency plan in place can provide peace of mind and help you navigate through unexpected expenses or financial hardships. Here’s why having an emergency fund is crucial:

1. Financial Cushion during Unexpected Events

An emergency fund serves as a safety net during unforeseen circumstances such as job loss, medical emergencies, or major home repairs. Instead of relying on credit cards or loans, having a dedicated fund allows you to cover essential expenses without going into debt.

2. Avoiding Debt and Maintaining Financial Independence

By having an emergency fund, you can reduce the likelihood of relying on debt to cover unexpected costs. Without it, you may be forced to take out high-interest loans or max out your credit cards, which can lead to long-term financial difficulties. Building and maintaining an emergency fund allows you to maintain your financial independence and avoid falling into unnecessary debt.

3. Peace of Mind in Times of Uncertainty

Knowing that you have a financial cushion to fall back on can provide immense peace of mind. It can alleviate stress and anxiety during challenging situations by providing a sense of security and stability. This allows you to focus on finding solutions rather than worrying about the financial implications.

4. Flexibility and Freedom to Make Decisions

Having an emergency fund gives you the flexibility and freedom to make important decisions without financial constraints. Whether it’s taking a career break, pursuing further education, or starting your own business, having a solid financial backup can provide you with the confidence to take calculated risks.

5. Building Long-Term Wealth

An emergency fund not only protects your short-term financial stability but also helps in building long-term wealth. By avoiding debt and having a safety net, you can focus on investing and growing your money, which can eventually lead to achieving your financial goals and securing a brighter future.

In conclusion, building an emergency fund is a vital aspect of safeguarding your financial stability. It provides a safety net during unexpected events, helps you avoid debt, provides peace of mind, and allows for financial flexibility. Start building your emergency fund today and take charge of your financial future.

Conclusion

Building an emergency fund is a crucial step in safeguarding your financial stability. It provides a safety net that can protect you and your family from unexpected financial setbacks. Having a reserve of funds readily available in times of emergencies can bring peace of mind and provide a sense of security.

An emergency fund offers you the flexibility to deal with unexpected expenses, such as medical emergencies, job loss, or unforeseen home repairs. Without a safety net, individuals often find themselves in a vulnerable position, having to rely on credit cards, loans, or even borrowing from friends and family. This can lead to a cycle of debt and financial stress, making it even harder to recover.