Tax-efficient investing is a strategy that aims to help investors maximize their returns while minimizing their tax liability. By employing various techniques and understanding the tax implications of different investments, individuals can effectively optimize their investment portfolios. In this article, we will explore the key principles of tax-efficient investing and provide insights on how to make the most of your investments while keeping your taxes in check.

One essential aspect of tax-efficient investing is understanding the impact of taxes on investment returns. Taxes can significantly reduce the amount of money investors take home from their investments, eating into potential gains. By strategically managing their portfolios, investors can minimize the amount of taxes they pay, allowing them to keep more of their hard-earned money. Through structures such as tax-efficient funds, proper asset location, and careful planning, investors can optimize their investment strategies to achieve higher after-tax returns.

The Basics of Tax-Efficient Investing

When it comes to investing, understanding how taxes can affect your returns is crucial. By implementing tax-efficient investing strategies, you can maximize your investment returns and minimize your tax liability. Here are the key considerations:

1. Utilize Tax-Advantaged Accounts

One of the first steps in tax-efficient investing is to take advantage of tax-advantaged accounts such as Individual Retirement Accounts (IRAs), 401(k)s, or Roth IRAs. These accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals.

2. Focus on Tax-Efficient Investments

Investing in tax-efficient assets can help reduce your tax burden. These assets include low-turnover index funds, tax-managed funds, or municipal bonds that offer tax-free interest income.

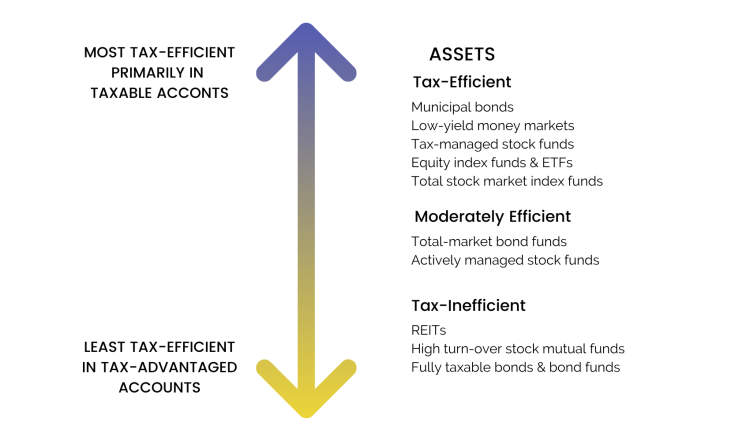

3. Consider Asset Location

The placement of different investments across taxable and tax-advantaged accounts can impact your overall tax liability. By strategically placing investments with higher tax implications in tax-advantaged accounts, you can minimize the taxes you owe.

4. Harvest Tax Losses

Tax loss harvesting is a strategy that involves selling investments at a loss to offset taxable gains. By doing so, you can reduce your capital gains tax liability and potentially generate tax savings.

5. Be Mindful of Dividends and Capital Gains Distributions

Dividends and capital gains distributions from mutual funds are taxable. Be aware of the tax implications of these distributions and consider investing in funds with lower distributions or holding them in tax-advantaged accounts.

6. Stay Informed about Tax Law Changes

Tax laws can change over time, and it’s important to stay updated. Keeping yourself informed about any tax law changes will enable you to adapt your investment strategies accordingly.

By understanding the basics of tax-efficient investing and implementing these strategies, you can optimize your investment returns while minimizing your tax liability.

Strategies for Maximizing Investment Returns

When it comes to investing, everyone wants to see their money grow. However, it is important to consider the impact of taxes on your investment returns. By employing tax-efficient investing strategies, you can maximize your returns while minimizing your tax liability. Here are some strategies to consider:

- Take advantage of tax-advantaged accounts: One of the most effective ways to minimize taxes on your investments is by utilizing tax-advantaged accounts such as IRAs and 401(k)s. Contributions to these accounts are made with pre-tax dollars, allowing your investments to grow tax-free until retirement.

- Harvest tax losses: Tax-loss harvesting involves selling investments that have experienced a loss in order to offset capital gains. By strategically selling losing investments, you can reduce your overall tax liability.

- Diversify your investments: By diversifying your investment portfolio, you can spread risk and potentially reduce taxes. Different investments may be subject to different tax rates, so having a mix of stocks, bonds, and other assets can help you optimize your returns.

- Consider tax-efficient funds: Some mutual funds and exchange-traded funds (ETFs) are specifically designed to be tax-efficient. These funds aim to minimize taxable distributions by investing in a way that reduces capital gains and dividends.

- Hold investments for the long term: Long-term capital gains are taxed at a lower rate than short-term gains. By holding onto your investments for longer periods of time, you may be able to take advantage of this favorable tax treatment.

- Avoid excessive trading: Frequent buying and selling of investments can trigger taxable events and increase your tax liability. It is often more tax-efficient to adopt a buy-and-hold strategy and make fewer trades.

- Consult with a tax professional: Tax laws and regulations can be complex and subject to change. Working with a qualified tax professional can help you navigate the tax implications of your investments and develop a personalized tax-efficient investing strategy.

By implementing these strategies, you can optimize your investment returns and keep more of your hard-earned money in your pocket. Remember, it is important to consult with a financial advisor or tax professional to ensure these strategies align with your specific financial goals and circumstances.

Minimizing Tax Liability: Tips and Tricks

When it comes to taxes, it’s important to take advantage of every opportunity to minimize your liability. By implementing these tips and tricks, you can maximize your returns while effectively reducing the amount of tax you owe.

Tax-Efficient Investing Strategies

1. Utilize tax-advantaged accounts such as Individual Retirement Accounts (IRAs), 401(k)s, or Health Savings Accounts (HSAs). These accounts offer tax benefits that can help minimize your tax liability.

2. Consider tax-loss harvesting, where you strategically sell investments at a loss to offset any capital gains you may have. This can reduce your taxable income and your overall tax bill.

3. Invest in tax-efficient funds or exchange-traded funds (ETFs) that focus on minimizing taxable distributions. These funds can help reduce the impact of taxes on your investment returns.

Take Advantage of Deductions and Credits

1. Stay informed about available tax deductions and credits. For example, you may be eligible for deductions related to education expenses, mortgage interest, or medical expenses.

2. Consider contributing to charitable organizations. Donations can not only make a positive impact but also provide you with potential tax deductions.

Structure Your Business and Investments Wisely

1. For small business owners, consider operating as a limited liability company (LLC) or an S corporation. These structures can provide tax advantages and liability protection.

2. Take advantage of tax-deferred retirement plans for self-employed individuals, such as a Simplified Employee Pension (SEP) IRA or a solo 401(k). These retirement plans allow you to save for the future while reducing your current tax liability.

Stay Organized and Plan Ahead

1. Keep detailed records of your income, expenses, and investments. This will not only help you maximize your deductions but also make tax filing easier and more accurate.

2. Plan your financial decisions with tax implications in mind. By considering how each transaction affects your taxes, you can make informed choices that minimize your tax liability.

By implementing these tips and tricks, you can navigate the complex world of taxes and maximize your returns while minimizing your tax liability.

Conclusion

Tax-efficient investing is a crucial strategy for investors who want to maximize their returns and minimize their tax liability. By understanding the various tax implications of different investment options, individuals can make informed decisions that can have a significant impact on their overall financial success.

One of the key ways to achieve tax efficiency is by carefully selecting investments that generate tax-efficient income. This can include investments such as tax-exempt municipal bonds or tax-managed funds. By focusing on investments that generate income that is taxed at a lower rate or not at all, investors can reduce their tax burden and ultimately increase their overall returns.