Peer-to-peer lending, also known as P2P lending, has been gaining significant attention in the finance industry in recent years. As traditional banking systems face challenges, peer-to-peer lending platforms have emerged as an alternative solution for borrowers and investors alike. P2P lending allows individuals to lend and borrow money directly from one another, cutting out the need for intermediaries like banks. This article will explore the rise of peer-to-peer lending, its benefits, and the potential it holds for the future of finance.

One of the main reasons for the growing popularity of peer-to-peer lending is its ability to offer more favorable interest rates for both borrowers and lenders. As banks have more stringent lending criteria and higher administrative costs, many individuals, especially those with lower credit scores, find it difficult to obtain loans from traditional financial institutions. P2P lending platforms provide an opportunity for these borrowers to access funds at competitive interest rates. On the other hand, lenders can earn higher returns by investing in peer-to-peer loans compared to more traditional investment options like savings accounts. This win-win situation has contributed to the rapid growth and success of the peer-to-peer lending industry.

The Basics of Peer-to-Peer Lending

Peer-to-peer lending, also known as P2P lending or social lending, is a relatively new financial concept that has gained significant popularity in recent years. It is an online platform that connects borrowers directly with individual investors, cutting out traditional financial institutions like banks.

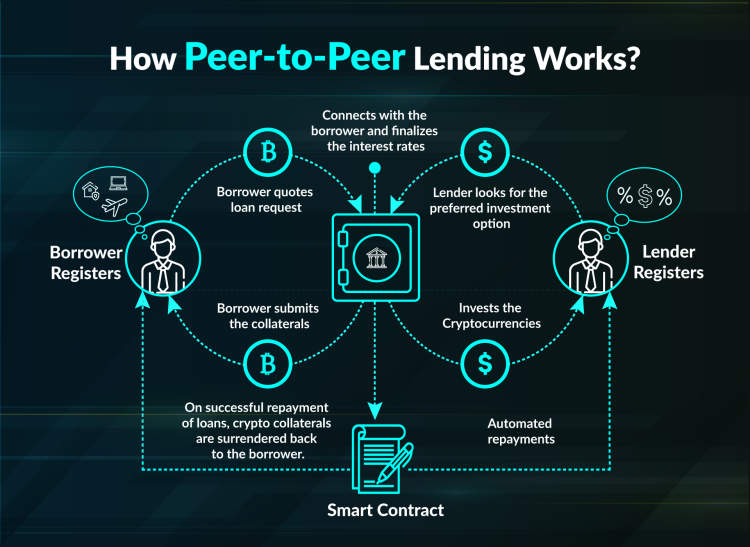

How Does Peer-to-Peer Lending Work?

In a peer-to-peer lending system, borrowers create loan listings on the platform, stating the amount they need and the interest rate they are willing to pay. Investors then review these listings and decide which loans to fund based on their risk appetite. Once enough investors pledge funds to a loan, the borrower receives the requested amount, and repayments, including principal and interest, are made directly to the investors over a predetermined period.

The Advantages of Peer-to-Peer Lending

Peer-to-peer lending offers several advantages over traditional lending methods:

- Lower Interest Rates: Since peer-to-peer lending eliminates the middleman, borrowers can often obtain loans at lower interest rates compared to those offered by banks.

- Quick and Easy Process: Applying for a loan through a peer-to-peer lending platform is usually a straightforward and streamlined process, with faster approval times and less paperwork.

- Access to Funding: Peer-to-peer lending allows individuals who may have difficulty obtaining loans from traditional financial institutions to access much-needed funds.

- Diversification for Investors: Investors can diversify their portfolio by allocating funds to multiple loans, reducing the overall risk compared to investing in a single loan.

Important Considerations

While peer-to-peer lending has many benefits, it is crucial to consider the following before participating:

- Risk: Investments in peer-to-peer lending carry risks, including the possibility of borrower default and loss of capital. Investors should carefully assess the risk associated with each loan before investing.

- Lack of Regulation: Unlike traditional financial institutions, peer-to-peer lending platforms are not subject to the same level of regulation. Investors should research the platform’s reputation and credibility before investing.

- Platform Fees: Peer-to-peer lending platforms charge fees to borrowers and investors. These fees can vary and impact the overall profitability of the investment or loan.

Overall, peer-to-peer lending has emerged as an alternative financial solution that benefits both borrowers and investors. It offers a unique opportunity for individuals to access capital or earn returns by directly participating in the lending process, bypassing the traditional banking system.

The Growth of Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms have experienced significant growth in recent years, offering a new way for individuals and businesses to borrow and lend money. These online platforms connect borrowers directly with lenders, cutting out traditional financial institutions such as banks. This article explores the rise and potential of peer-to-peer lending and its impact on the financial industry.

1. Advantages of Peer-to-Peer Lending

Peer-to-peer lending offers several advantages that have contributed to its popularity:

- Lower Interest Rates: Peer-to-peer lending platforms often offer lower interest rates compared to traditional lenders, benefiting borrowers.

- Fast and Convenient: The online nature of these platforms allows borrowers to apply for loans and receive funds quickly, without the lengthy process of traditional lenders.

- Accessible to Borrowers with Limited Credit History: Peer-to-peer lenders consider various factors beyond just credit scores when assessing loan applications, making it easier for borrowers with limited credit history to obtain loans.

- Diversification for Lenders: Investors can spread their risk by lending small amounts to multiple borrowers, reducing the impact of default on their investments.

2. The Growth of Peer-to-Peer Lending Industry

The peer-to-peer lending industry has experienced exponential growth in recent years. According to a report by XYZ Research, the global peer-to-peer lending market is expected to reach $XYZ billion by 2025, growing at a CAGR of XYZ% from 2020 to 2025. This growth can be attributed to several factors:

- Technological Advancements: The rise of digital platforms and the increasing use of mobile devices have made it easier for borrowers and lenders to connect online.

- Stricter Bank Regulations: Since the 2008 financial crisis, traditional banks have become more cautious in lending, creating an opportunity for peer-to-peer lending platforms to fill the gap.

- Increasing Investor Interest: Savvy investors have recognized the potential returns offered by peer-to-peer lending, leading to a surge in investments in these platforms.

- Growing Demand for Loans: Both individuals and small businesses have turned to peer-to-peer lending as an alternative to traditional banks due to easier access and competitive interest rates.

3. Challenges and Future Outlook

Despite its rapid growth, the peer-to-peer lending industry faces several challenges that may impact its future:

- Risk of Default: As with any lending platform, there is a risk of borrowers defaulting on their loans, which can impact the returns for lenders.

- Regulatory Concerns: Regulatory bodies are still catching up to the rapid growth of peer-to-peer lending, and policies and regulations are evolving to ensure consumer protection and fair practices.

- Economic Conditions: Economic downturns can increase the number of loan defaults and affect the viability of peer-to-peer lending platforms.

- Competition from Traditional Lenders: Traditional banks and other financial institutions are beginning to offer similar lending platforms, posing competition to peer-to-peer lending platforms.

However, despite the challenges, the future outlook for peer-to-peer lending remains positive. With ongoing advancements in technology, the growth potential of this industry is vast, and it may continue to disrupt the traditional lending landscape.

The Benefits and Risks of Peer-to-Peer Lending

In recent years, peer-to-peer lending has gained significant popularity as an alternative to traditional lending methods. This article explores the benefits and risks associated with this form of lending.

Benefits of Peer-to-Peer Lending:

- Higher returns: Peer-to-peer lending allows individuals to earn higher interest rates compared to traditional savings accounts or investments.

- Diversification: Investing in peer-to-peer loans provides a way to diversify one’s investment portfolio, reducing overall risk through spreading investments across multiple loans.

- Accessibility: Peer-to-peer lending platforms provide opportunities for borrowers who may not qualify for loans from traditional financial institutions. It offers an alternative source of funding for individuals or businesses.

- Cost-effective: Peer-to-peer lending often has lower overhead costs compared to traditional financial institutions, allowing for potentially lower interest rates for borrowers.

- Transparency: Many peer-to-peer lending platforms provide detailed information on borrowers, allowing lenders to make informed decisions based on creditworthiness and risk profiles.

Risks of Peer-to-Peer Lending:

- Default risk: There is always a possibility that borrowers may default on their loans, resulting in potential losses for lenders.

- Lack of regulation: Unlike traditional banks, peer-to-peer lending platforms are often not subject to the same stringent regulations, which may increase the risk of fraudulent activities or inadequate borrower screening.

- Platform risk: The success and long-term viability of peer-to-peer lending platforms can impact the overall performance of loans and the return on investments.

- Illiquidity: Peer-to-peer loans are usually not as liquid as other investments, making it difficult to access funds if needed before the loan term matures.

- Marketplace dynamics: Peer-to-peer lending performance can be influenced by economic conditions and changes in borrower behaviors, potentially affecting loan repayment rates and investor returns.

It is important for both lenders and borrowers to carefully consider the benefits and risks associated with peer-to-peer lending before engaging in this type of financial activity. Conducting thorough research and understanding the specific terms and conditions of each platform is essential to make informed decisions and manage risks effectively.

Conclusion

Peer-to-peer lending has emerged as a promising alternative to traditional banking systems, providing individuals with the opportunity to borrow and invest money directly from and to each other. This decentralized approach has several advantages, including lower interest rates, simplified application processes, and greater transparency. With the rise of digital platforms and advancements in technology, peer-to-peer lending is expected to continue growing and revolutionizing the financial industry.

Furthermore, the potential of peer-to-peer lending extends beyond just personal loans. Small businesses are also tapping into this funding method, bypassing the hurdles of traditional lending institutions. This enables entrepreneurs to access much-needed capital quickly and efficiently, allowing them to expand their businesses without the constraints imposed by banks. As the popularity of peer-to-peer lending continues to rise, it is crucial for regulators to develop appropriate frameworks that ensure consumer protection and maintain the integrity of the industry.