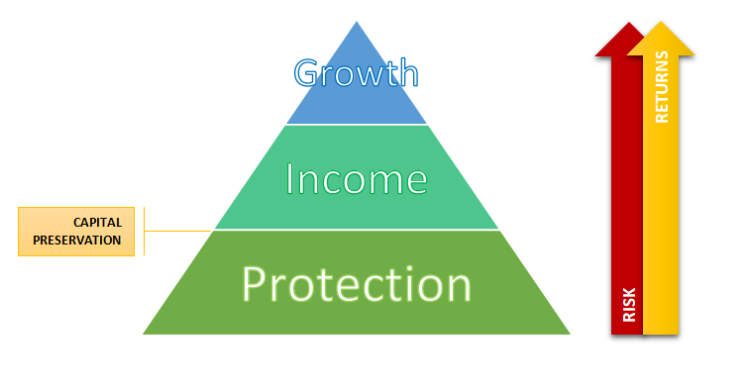

When it comes to financial planning, there is one important aspect that should always be given top priority – capital preservation. This fundamental principle ensures that investors and individuals protect their hard-earned money from unnecessary risks and potential losses. In today’s volatile and uncertain economic landscape, understanding and implementing capital preservation strategies can make a significant difference in achieving long-term financial security.

Capital preservation involves minimizing the potential for capital erosion or loss, while still aiming for reasonable returns. It focuses on safeguarding the principal amount invested and reducing the exposure to market downturns or unexpected financial events. By prioritizing capital preservation in financial planning, individuals can ensure the stability and sustainability of their investment portfolios, thus providing a solid foundation for future wealth accumulation and financial well-being.

The Role of Capital Preservation in Financial Planning

When it comes to financial planning, one crucial aspect that often gets overlooked is capital preservation. While the primary goal of many individuals is to grow their wealth, it is equally important to protect and preserve the capital that has been accumulated over time. Capital preservation plays a vital role in achieving long-term financial stability and reaching your financial goals.

1. Protecting Against Market Volatility

One of the key reasons why capital preservation is important is to safeguard your investments against market volatility. Financial markets can experience significant fluctuations, and sudden downturns can erode your investment capital. By prioritizing capital preservation, you can minimize the impact of market downturns and protect your wealth from substantial losses.

2. Ensuring a Safety Net

Capital preservation also acts as a safety net during emergencies or unforeseen circumstances. Life is full of uncertainties, and having a pool of preserved capital provides you with the necessary resources to handle unexpected events such as job loss, medical emergencies, or other financial setbacks. By preserving your capital, you can ensure financial security and maintain peace of mind even during challenging times.

3. Facilitating Future Investment Opportunities

Preserving your capital allows you to take advantage of future investment opportunities. By maintaining a solid financial foundation, you ensure that you have the necessary funds available when promising investment prospects arise. Whether it’s purchasing real estate, starting a business, or investing in new ventures, having preserved capital gives you the flexibility and financial strength to seize potential opportunities.

4. Supporting Long-Term Financial Goals

Capital preservation is vital for achieving long-term financial goals. Whether your objective is to retire comfortably, fund your children’s education, or leave a legacy for future generations, preserving your capital ensures that you have the financial resources needed to fulfill those aspirations. By protecting and growing your capital, you increase the likelihood of attaining long-term financial security.

5. Balancing Risk and Return

Effective financial planning relies on striking the right balance between risk and return. While higher-risk investments can offer potentially greater returns, they also come with increased exposure to potential losses. Capital preservation allows you to diversify your investment portfolio and mitigate risks. By allocating a portion of your funds towards preserving capital, you can achieve a more balanced and stable financial plan.

Strategies for Safeguarding and Preserving Your Capital

When it comes to financial planning, one crucial aspect that cannot be overlooked is capital preservation. Safeguarding your capital ensures that your hard-earned money is protected and remains intact, even in times of market turbulence or economic uncertainty. To help you achieve this, here are some effective strategies to consider:

- Diversification: One of the fundamental principles of capital preservation is diversifying your investments. By spreading your capital across different asset classes, industries, or geographical regions, you reduce the risk of losing a significant portion of your portfolio if one sector faces a downturn. Diversification can help cushion the impact of market volatility and maintain the overall value of your capital.

- Asset Allocation: Crafting a well-balanced asset allocation strategy is crucial for capital preservation. This involves determining the appropriate mix of stocks, bonds, cash, and other investments based on your risk tolerance, financial goals, and time horizon. By properly allocating your assets, you can optimize returns while minimizing the potential for capital erosion.

- Regular Portfolio Review: Regularly reviewing and monitoring your investment portfolio is essential for preserving your capital. Keep a close eye on market trends, economic indicators, and changes in the competitive landscape. By staying informed, you can make informed decisions about rebalancing your portfolio or realigning your investments to safeguard your capital from potential risks.

- Risk Management: Implementing risk management strategies is vital for capital preservation. This can include appropriate hedging techniques, using stop-loss orders, or investing in defensive assets during uncertain times. By actively managing risk, you can protect your capital from sudden market downturns and unexpected events.

- Emergency Fund: Maintaining an emergency fund is a crucial component of preserving your capital. Setting aside a portion of your capital in a readily accessible account provides a financial safety net during unexpected expenses or job loss. Having an emergency fund in place ensures that you do not have to dip into your long-term investments to cover unforeseen circumstances.

In conclusion, capital preservation is a fundamental aspect of financial planning. By implementing effective strategies such as diversification, asset allocation, regular portfolio review, risk management, and maintaining an emergency fund, you can safeguard and preserve your capital even in uncertain times. Remember, protecting your capital today lays the foundation for a secure financial future.

The Benefits of Prioritizing Capital Preservation in Your Financial Decision-Making

When it comes to financial planning, one aspect that should not be overlooked is capital preservation. Prioritizing capital preservation in your decision-making process can bring numerous benefits and help safeguard your financial well-being in the long run.

1. Protection against market volatility

In an unpredictable financial market, capital preservation serves as a shield against the inherent risks of investing. By allocating a portion of your portfolio to low-risk or capital preservation strategies, you can reduce the impact of market downturns and protect your wealth.

2. Stability and peace of mind

Knowing that your capital is being preserved can provide a sense of stability and peace of mind. Financial decisions that prioritize capital preservation focus on minimizing losses, allowing you to maintain a stable financial position even during challenging economic times.

3. Flexibility and opportunity

Preserving your capital provides you with the flexibility to seize opportunities when they arise. By having a portion of your funds readily available, you can take advantage of favorable investment prospects or unexpected financial needs without jeopardizing your financial security.

4. Long-term wealth growth

Contrary to the common belief that high-risk investments yield the highest returns, prioritizing capital preservation can contribute to long-term wealth growth. By avoiding significant losses during market downturns, your portfolio can benefit from compounding returns and sustainable growth over time.

5. Risk management and diversification

Capital preservation is an essential aspect of risk management and diversification. By preserving your capital, you can allocate funds to various asset classes and investment strategies, enhancing your overall investment portfolio’s risk-adjusted returns.

Conclusion

In conclusion, capital preservation is a crucial aspect of financial planning. It allows individuals to safeguard their wealth and protect against unexpected events and market downturns. By prioritizing capital preservation, investors can ensure a stable foundation for their financial future.

Furthermore, capital preservation helps in achieving long-term financial goals. By avoiding unnecessary risks and preserving capital, individuals can have the peace of mind to pursue their objectives, such as retirement planning, education funding, or launching a business. Capital preservation is not only about preserving wealth but also about maintaining financial security and flexibility.