The future of cryptocurrency holds the potential for a groundbreaking transformation in the realm of digital transactions. As traditional financial systems face limitations and challenges, the rise of cryptocurrencies presents a paradigm shift that promises to redefine how we exchange value in an increasingly digitized world.

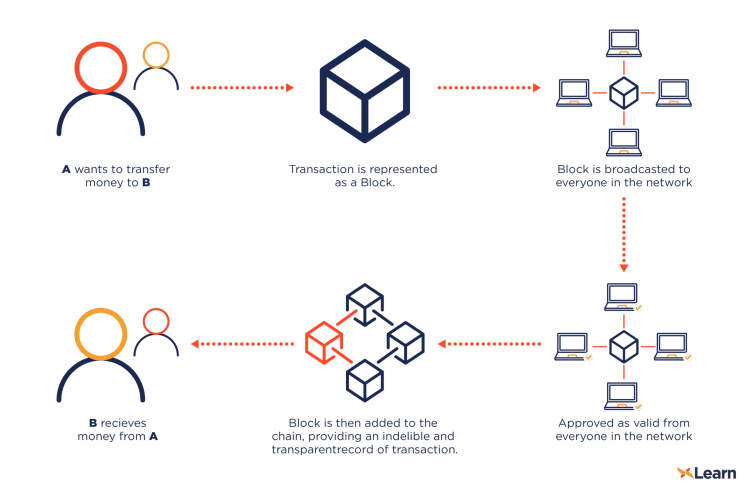

Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as disruptive forces, offering decentralized and secure alternatives to traditional banking and payment systems. The underlying technology behind these digital currencies known as blockchain, introduces a transparent and tamper-proof ledger, revolutionizing trust and eliminating the need for intermediaries. This revolutionary technology has the potential to reshape numerous industries, including finance, supply chain management, voting systems, and more.

Introduction to Cryptocurrency

In recent years, cryptocurrency has emerged as a revolutionary form of digital currency that is changing the way we perceive and transact with money. Powered by blockchain technology, cryptocurrencies like Bitcoin, Ethereum, and Litecoin have gained popularity, attracting the attention of investors, tech enthusiasts, and even governments.

With its decentralized nature, cryptocurrencies offer a range of advantages over traditional financial systems. Here, we will explore the key features and benefits of cryptocurrencies, as well as the potential implications they may have on the future of digital transactions.

Key Features of Cryptocurrency

- Decentralization: Unlike traditional currencies that are controlled by central banks, cryptocurrencies operate on a peer-to-peer network, making them immune to government interference and censorship.

- Security: Cryptocurrencies use cryptographic techniques to secure transactions, ensuring the integrity and privacy of digital assets.

- Transparency: Every transaction made with cryptocurrency is recorded on a public ledger known as the blockchain, providing a transparent and tamper-proof record of all transactions.

- Global Accessibility: Due to their digital nature, cryptocurrencies can be accessed and used by anyone with an internet connection, regardless of their geographical location.

Benefits of Cryptocurrency

Cryptocurrencies offer several advantages that make them appealing to a wide range of users:

- Lower Fees: Traditional banking systems often impose high fees for international transactions, whereas cryptocurrencies enable low-cost cross-border transfers.

- Financial Inclusion: Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations, empowering them with access to digital transactions.

- Protection against Inflation: Some cryptocurrencies have limited supplies, making them resistant to inflation and preserving the value of digital assets.

- Opportunities for Investment: Cryptocurrencies have generated significant returns for early adopters, attracting investors looking for alternative assets and promising investment opportunities.

As the world becomes increasingly digital, the future of cryptocurrency holds immense potential. It has the power to revolutionize the way we conduct financial transactions, eliminate intermediaries, and foster financial inclusivity. However, challenges such as regulatory concerns, market volatility, and scalability need to be addressed for widespread adoption and acceptance.

The Current Landscape of Digital Transactions

In recent years, digital transactions have become increasingly prevalent in our everyday lives. With the advancement of technology and the growing popularity of online shopping, the way we conduct financial transactions has undergone a significant shift. Here, we will explore the current landscape of digital transactions and delve into the various methods and trends that have shaped this modern era of commerce.

The Rise of E-wallets

E-wallets, also known as digital wallets, have emerged as a popular alternative to traditional payment methods. These virtual wallets allow users to securely store their payment information and make purchases online with ease. With the convenience they offer, e-wallets have gained traction worldwide, revolutionizing the way we transact digitally.

Contactless Payment

Advancements in contactless payment technology have further propelled the growth of digital transactions. Contactless payments, enabled by near-field communication (NFC) technology, allow users to complete transactions by simply tapping their cards or smartphones on payment terminals. This method offers speed, simplicity, and enhanced security, making it a preferred choice for many consumers.

The Adoption of Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have garnered significant attention in recent years. These decentralized digital currencies operate on blockchain technology, offering a secure and transparent way to conduct transactions. The increasing acceptance and integration of cryptocurrencies by businesses and financial institutions have paved the way for a potential paradigm shift in the digital transactions landscape.

Security Concerns and Solutions

While the convenience of digital transactions is undeniable, security concerns remain a key consideration. With the rise in cybercrime, protecting sensitive financial information is of utmost importance. To address these concerns, various security measures such as two-factor authentication, encryption technologies, and fraud detection systems have been implemented to ensure the safety of digital transactions.

The Future of Digital Transactions

Looking ahead, the future of digital transactions holds immense potential. With the continuous development of technology and the advent of innovative solutions, we can expect further advancements in areas such as biometric authentication, artificial intelligence, and blockchain integration. These advances will likely shape a more seamless, secure, and efficient digital transaction landscape.

Emerging Trends in Cryptocurrency

Cryptocurrency has revolutionized the way we conduct digital transactions. As the technology continues to evolve, several emerging trends are shaping the future of cryptocurrency:

1. Decentralized Finance (DeFi)

DeFi is one of the most significant trends in cryptocurrency. It aims to recreate traditional financial systems using blockchain technology, eliminating intermediaries and offering financial services such as lending, borrowing, and investing.

2. Non-Fungible Tokens (NFTs)

NFTs have gained immense popularity recently. They are unique digital assets that can represent ownership of assets like art, music, or virtual real estate. NFTs utilize blockchain technology to ensure authenticity and scarcity.

3. Central Bank Digital Currencies (CBDCs)

CBDCs are digital currencies issued by central banks. These cryptocurrencies offer the advantages of traditional fiat currencies while leveraging the benefits of blockchain technology. Several countries are actively exploring CBDC implementation.

4. Cross-Chain Interoperability

Interoperability is a crucial area of development in the cryptocurrency space. Different blockchain networks are working on cross-chain solutions that allow seamless transfer of assets and information between different cryptocurrency platforms.

5. Enhanced Privacy and Security

Privacy and security are integral to the future success of cryptocurrency. Developers are focusing on enhancing privacy features through technologies like Zero-Knowledge Proofs and implementing robust security measures to protect against hacking and fraud.

6. Sustainable and Energy-Efficient Solutions

The environmental impact of cryptocurrencies, especially Bitcoin, has raised concerns. As a response, emerging trends are exploring sustainable and energy-efficient solutions to minimize the carbon footprint of cryptocurrency mining and transactions.

7. Integration with Traditional Finance

The integration of cryptocurrencies with traditional finance is gaining momentum. Financial institutions are exploring ways to incorporate cryptocurrencies into their services, including accepting cryptocurrency payments and offering crypto-focused investment products.

Conclusion

The future of cryptocurrency holds tremendous potential as it promises to revolutionize the way we conduct digital transactions. With its decentralized nature and security measures, cryptocurrencies like Bitcoin have shown the world the possibilities of a new financial paradigm. As more people become aware of the advantages of cryptocurrencies, we can expect to see a significant shift in the way we perceive and utilize digital money.

One key aspect of cryptocurrency that sets it apart from traditional banking systems is its transparency. The underlying blockchain technology ensures that all transactions are recorded and can be accessed by anyone, making the financial system more accountable and resistant to fraud. Additionally, the accessibility of cryptocurrencies opens up new opportunities for individuals who were previously excluded from traditional banking services. The low transaction fees and fast processing times make it easier for people in developing countries to participate in the global economy.