Retirement planning is a crucial aspect of securing your financial future and ensuring a comfortable retirement. It involves making strategic decisions and taking appropriate steps to build a nest egg that will support you during your golden years. However, with the vast amount of information available, it can be overwhelming to know where to start. In this article, we will outline 10 essential steps for retirement planning that will help simplify the process and set you on the right path.

The first step in retirement planning is to determine your retirement goals and aspirations. Consider the lifestyle you want to maintain and the activities you wish to pursue during retirement. This will give you a clear vision of the financial resources you’ll need to support your desired lifestyle. Additionally, it’s essential to evaluate your current financial situation, including your assets, income, and liabilities. This assessment will help you gauge where you stand financially and identify areas that require attention to achieve your retirement goals.

Setting Retirement Goals

Retirement planning is an essential part of securing your financial future. To effectively plan for retirement, it is important to set clear goals that align with your desired lifestyle and financial needs. Here are some steps to help you set retirement goals:

1. Determine Your Retirement Age

Decide on the age at which you wish to retire. Consider factors like your health, financial situation, and personal preferences.

2. Assess Your Current Financial Position

Evaluate your current savings, investments, and assets. This will help you understand the gap between your existing financial situation and your retirement goals.

3. Calculate Your Retirement Expenses

List all your expected expenses during retirement, including housing, healthcare, travel, hobbies, and daily living costs. Make sure to account for inflation.

4. Determine Your Retirement Income

Identify potential sources of retirement income, such as pensions, Social Security benefits, investments, and other savings. Calculate the estimated income you can expect to receive.

5. Set Financial Milestones

Break down your retirement goals into smaller milestones that are easier to achieve. This can help you track your progress and stay motivated.

6. Assess Your Risk Tolerance

Determine your risk tolerance level when it comes to investing. This will guide you in creating a balanced investment portfolio that aligns with your goals and comfort level.

7. Save and Invest Regularly

Develop a savings and investment strategy that allows you to consistently contribute towards your retirement goals. Consider utilizing retirement accounts like 401(k)s and IRAs for tax advantages.

8. Monitor and Adjust Your Plan

Regularly review your retirement plan to ensure it stays aligned with your evolving goals and financial situation. Make adjustments as needed to stay on track.

9. Seek Professional Guidance

Consider consulting with a financial advisor who specializes in retirement planning. They can provide personalized advice and help optimize your retirement strategy.

10. Stay Disciplined and Flexible

Maintain discipline in sticking to your retirement savings and investment plan. Be open to adjusting your goals and strategies if necessary, especially as circumstances change.

Calculating Retirement Expenses

Planning for retirement involves considering various financial aspects, and one of the key factors to consider is calculating your retirement expenses. By accurately estimating the expenses you will incur during your retirement years, you can better prepare financially and ensure a comfortable retirement. Here are some essential steps to help you in calculating your retirement expenses:

Identify your current expenses:

Start by evaluating your current monthly expenses. This includes everything from housing costs, utility bills, transportation expenses, healthcare costs, groceries, entertainment, and any other regular expenses you have. Knowing your current expenses will serve as a baseline for estimating your future retirement expenses.

Consider inflation:

Keep in mind that the cost of living will likely increase over time due to inflation. Consider how inflation might affect your retirement expenses and adjust your calculations accordingly.

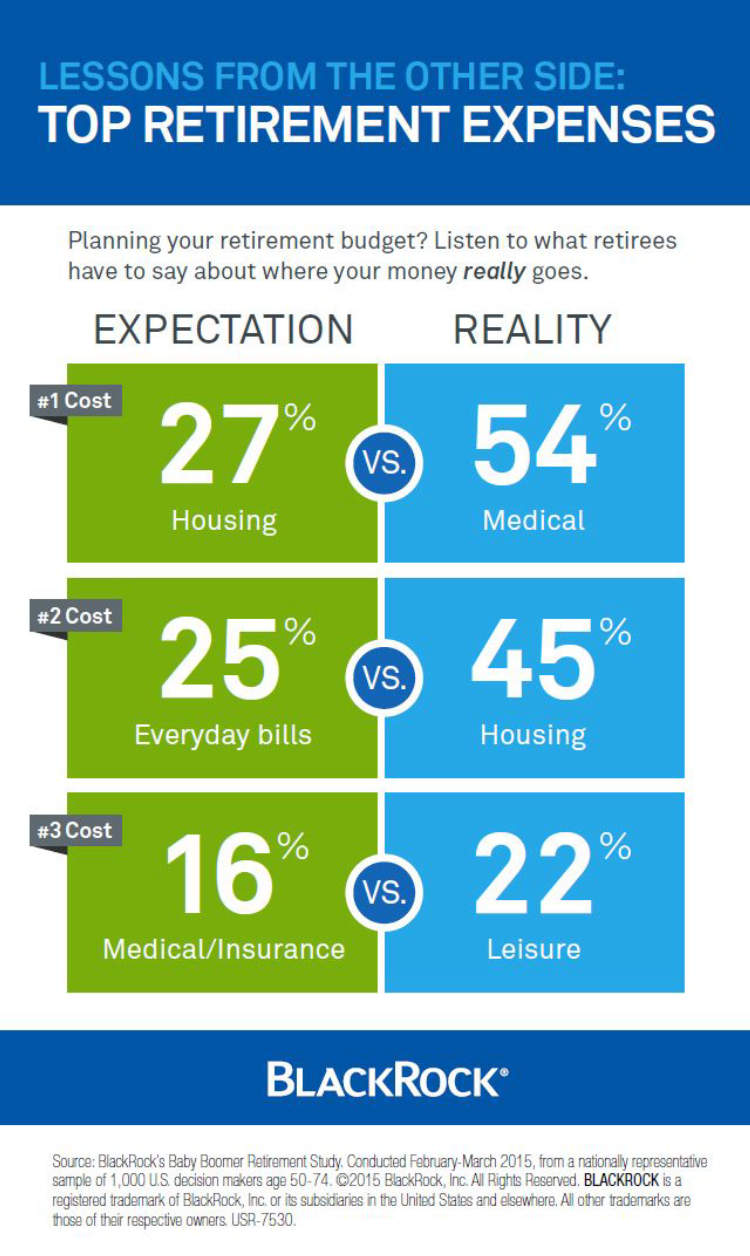

Anticipate healthcare costs:

Healthcare expenses tend to rise as we age, so it’s crucial to factor in potential medical costs during retirement. Consider the premiums for health insurance, medication expenses, regular check-ups, and any possible future healthcare needs. Don’t forget to account for long-term care costs if applicable.

Plan for housing expenses:

Decide whether you want to downsize or stay in your current home during retirement. Assess your housing expenses, including mortgage payments, property taxes, insurance, maintenance costs, and utilities. Adjust these expenses based on your retirement housing plans.

Estimate discretionary expenses:

Retirement is a time to enjoy life, and you might want to allocate a portion of your budget for travel, hobbies, dining out, or other discretionary activities. Estimate how much you would like to allocate for these expenses and adjust your overall retirement budget accordingly.

Factor in other income sources:

Consider any other sources of income you may have during retirement, such as Social Security benefits, pension plans, or rental income. Take into account the potential amount of income you will receive from these sources and adjust your retirement expenses accordingly.

Review and reassess regularly:

As you go through different stages of life and as circumstances change, it’s important to review and reassess your retirement expenses. Keep track of your expenses and adjust your calculations accordingly to ensure your retirement planning stays on track.

Calculating your retirement expenses requires careful consideration and planning. By following these essential steps, you can gain a clearer understanding of your future financial needs and make informed decisions to secure a comfortable retirement.

Creating a Retirement Savings Plan

When it comes to retirement planning, it’s crucial to have a solid savings plan in place. Here are 10 essential steps to help you create a retirement savings plan that ensures a comfortable future:

- Assess your current financial situation: Take stock of your savings, investments, and any retirement accounts you may have. Determine how much you have and how much you will need for retirement.

- Set achievable retirement goals: Decide on the age you want to retire and the lifestyle you want to maintain. This will help you estimate how much money you will need for a comfortable retirement.

- Create a budget: Analyze your expenses and income to establish a budget that allows you to save for retirement while still meeting your current financial obligations.

- Maximize your employer’s retirement plan: Contribute the maximum amount allowed to your employer’s retirement plan, especially if they offer a matching contribution.

- Explore individual retirement accounts (IRAs): Consider opening an IRA to supplement your employer’s retirement plan. There are traditional and Roth IRAs to choose from, each with its own tax advantages.

- Invest wisely: Research and diversify your investments to maximize potential returns and minimize risk. Consult with a financial advisor if needed.

- Monitor and adjust your plan: Regularly review your retirement savings plan and make adjustments as necessary. This includes increasing contributions as your income grows and reassessing your investment strategy.

- Consider healthcare costs: Factor in potential healthcare expenses during retirement and explore options like long-term care insurance to protect your savings.

- Prepare for unexpected events: Build an emergency fund to cover unexpected expenses and create a plan for potential scenarios such as disability or the need for long-term care.

- Seek professional advice: Consider consulting a financial advisor who specializes in retirement planning to ensure you are on the right track and to receive personalized advice.

Remember, creating a retirement savings plan requires careful consideration and ongoing commitment. Start early and stick to your plan to ensure a financially secure future.

Investing for Retirement

When it comes to retirement planning, investing wisely is crucial to ensure a comfortable and secure future. Here are 10 essential steps to help you in your retirement investment journey:

1. Set your retirement goals

Start by determining your financial goals for retirement. Consider factors like lifestyle, healthcare expenses, and travel aspirations. This will help you determine how much you need to save and invest.

2. Assess your risk tolerance

Evaluate your willingness to take risks with your investments. Understanding your risk tolerance will guide you in selecting investment options that align with your comfort level.

3. Start saving early

The earlier you start saving for retirement, the more time your investments have to grow. Take advantage of compounding returns by starting to save as soon as possible.

4. Diversify your portfolio

Spread your investments across different asset classes, such as stocks, bonds, and real estate. This diversification helps reduce risk and maximize potential returns.

5. Consider tax-efficient investments

Look for investment options that offer tax benefits for retirement savings, such as individual retirement accounts (IRAs) or employer-sponsored 401(k) plans. These can help you save on taxes and grow your retirement funds faster.

6. Regularly review and rebalance

Monitor your investments periodically to ensure they align with your goals. Consider rebalancing your portfolio if certain assets become over- or underrepresented, maintaining your desired asset allocation.

7. Seek professional advice

Consider consulting with a financial advisor who specializes in retirement planning. They can provide valuable insights and help you create a personalized investment strategy.

8. Prepare for inflation

Take into account the impact of inflation on your retirement savings. Invest in assets that have historically outpaced inflation to preserve your purchasing power over the long term.

9. Stay informed

Keep yourself updated on market trends, economic indicators, and investment opportunities. Stay informed to make well-informed decisions about your retirement investments.

10. Regularly monitor your progress

Regularly assess how well your investments are performing and adjust your strategy if needed. Retirement planning is an ongoing process, so staying vigilant is important.

Maximizing Retirement Account Contributions

Planning for retirement involves careful consideration and strategic decisions. One crucial aspect is maximizing your retirement account contributions, which can significantly impact your financial security in the future. Here are ten essential steps to follow when planning for retirement:

1. Start Early

Time is your ally when it comes to building a substantial retirement nest egg. The earlier you begin contributing to your retirement accounts, the more time you have for your investments to grow and compound.

2. Understand Contribution Limits

Familiarize yourself with the contribution limits set by the government for various retirement accounts, such as 401(k)s and IRAs. Ensure that you contribute up to the maximum allowable amount each year to take full advantage of the tax benefits and potential employer matching contributions.

3. Contribute Regularly

Consistency is key. Make contributions to your retirement accounts on a regular basis, whether it’s monthly, bi-monthly, or per paycheck. Automating your contributions can help ensure that you don’t miss out on saving opportunities.

4. Take Advantage of Employer Matching

If your employer offers a matching contribution to your retirement account, make sure to contribute at least enough to receive the maximum match. It’s essentially free money that can boost your retirement savings.

5. Consider Catch-Up Contributions

Once you reach the age of 50, you become eligible for catch-up contributions, which allow you to contribute additional funds to your retirement accounts. Take advantage of this opportunity to accelerate your savings if you haven’t saved enough in previous years.

6. Diversify Your Investments

Avoid putting all your eggs in one basket. Diversify your retirement investments across a range of assets, such as stocks, bonds, and mutual funds, to minimize risk and maximize potential returns.

7. Consider Roth Accounts

Depending on your financial situation and goals, consider contributing to Roth retirement accounts in addition to traditional ones. Roth accounts offer tax-free withdrawals in retirement, providing a tax advantage in the long run.

8. Continuously Monitor and Adjust

Keep a close eye on your retirement accounts and regularly review your investment strategies. Adjust your contributions and asset allocations as needed to align with your changing goals and risk tolerance.

9. Control Withdrawals

Once you reach retirement age, plan your withdrawals strategically. Be aware of required minimum distributions (RMDs) and consider tax-efficient withdrawal strategies to minimize your tax obligations and make your savings last.

10. Seek Professional Advice

Consulting with a financial advisor or retirement planning expert can provide valuable guidance tailored to your specific circumstances. They can help optimize your retirement account contributions and ensure that you are on track to meet your retirement goals.

Evaluating Social Security Benefits

Social Security benefits play a crucial role in retirement planning. It is important to evaluate these benefits carefully to maximize your income during your golden years. Here are some key factors to consider:

1. Understanding Your Eligibility

First and foremost, you need to determine your eligibility for Social Security benefits. Check if you have accumulated enough work credits and have reached the required age to receive benefits.

2. Estimating Your Benefit Amount

Use online tools or consult with Social Security representatives to estimate your benefit amount. Knowing this will help you make informed decisions about your retirement income needs.

3. Assessing Different Claiming Strategies

Social Security offers various claiming strategies that can impact your benefit amount. Research and evaluate which strategy aligns best with your retirement goals.

4. Considering Full Retirement Age

Full Retirement Age (FRA) is the age at which you can receive your full Social Security benefit. Evaluate the advantages and disadvantages of claiming benefits early or delaying until FRA.

5. Factoring in Spousal Benefits

If you are married or divorced, consider how spousal benefits can impact your overall retirement income. Evaluate different scenarios to maximize benefits for both partners.

6. Understanding the Tax Implications

Social Security benefits may be subject to federal income tax, depending on your total income. Consider the potential tax implications and plan accordingly.

7. Evaluating Work and Earnings Limitations

If you plan to work during your retirement years, be aware of the earnings limit set by Social Security. Evaluate how continuing to work may affect your benefits.

8. Factoring in Health and Longevity

Your health and life expectancy can impact the decision of when to start claiming Social Security benefits. Evaluate your health status and projected longevity for optimal planning.

9. Considering Other Retirement Income Sources

Social Security benefits alone may not be enough to meet your retirement income needs. Evaluate other potential income sources, such as pensions, investments, or part-time work.

10. Consulting with a Financial Advisor

Seeking advice from a financial advisor specializing in retirement planning can be invaluable. They can help you evaluate your Social Security options and create a comprehensive retirement strategy.

Considering Healthcare Costs

When planning for retirement, it is essential to factor in healthcare costs, which can significantly impact your financial well-being. Here are 10 essential steps to help you prepare:

- Evaluate your current healthcare coverage: Assess the coverage provided by your employer or any existing insurance policies to understand what expenses are already covered.

- Research Medicare: Familiarize yourself with the different Medicare plans available, including Parts A, B, C, and D, and determine which options best suit your needs.

- Consider long-term care insurance: Long-term care insurance can help cover expenses for nursing homes, home healthcare, or assisted living, providing you with peace of mind for the future.

- Estimate future healthcare costs: Use online resources or consult with a financial advisor to get an estimate of how much healthcare expenses you are likely to incur during retirement.

- Create a budget: Develop a comprehensive retirement budget that includes projected healthcare costs, such as premiums, deductibles, prescriptions, and potential medical emergencies.

- Build an emergency fund: Set aside funds specifically for unexpected medical expenses to avoid financial strain in case of emergencies.

- Focus on a healthy lifestyle: Prioritize maintaining good health through exercise, a balanced diet, and regular check-ups to reduce the risk of developing costly chronic conditions later in life.

- Consider health savings accounts (HSAs): Explore the benefits of opening an HSA to save tax-free dollars for medical expenses, both during retirement and while you are still working.

- Stay informed about healthcare reforms: Keep up-to-date with changes in healthcare policies and reforms, as they can have significant implications on your retirement healthcare costs.

- Consult with a financial advisor: Seek guidance from a financial advisor who specializes in retirement planning to ensure you have a solid strategy in place to cover your healthcare expenses during retirement.

Managing Debt and Expenses

When it comes to retirement planning, managing debt and expenses is a crucial aspect that cannot be overlooked. To ensure a smooth and financially secure retirement, here are 10 essential steps to consider:

1. Evaluate your current financial situation

Start by assessing your existing debt, monthly expenses, and income sources. This will give you a clearer picture of where you stand financially and how much you can allocate towards retirement savings.

2. Create a realistic budget

Develop a detailed budget that takes into account your daily expenses, debt repayments, and retirement savings goals. This will help you manage your money effectively and avoid unnecessary debt.

3. Prioritize debt repayment

If you have outstanding loans or credit card debt, focus on paying off high-interest debts first. This will reduce your financial burden and provide you with more resources to save for retirement.

4. Cut unnecessary expenses

Identify areas where you can cut back on expenses, such as dining out, entertainment, or subscription services. Redirect the money saved towards your retirement savings.

5. Consolidate and refinance debts

If managing multiple debts becomes overwhelming, consider consolidating them into a single loan with lower interest rates. Refinancing can also help reduce your monthly payments, freeing up more cash for retirement savings.

6. Maximize employer retirement benefits

Take full advantage of any retirement benefits offered by your employer, such as matching contributions to a 401(k) or pension plans. Contribute the maximum amount possible to ensure you’re not leaving any free money on the table.

7. Explore additional sources of income

Consider ways to generate extra income during your working years, whether through part-time jobs or monetizing your hobbies and skills. This can provide an additional financial cushion for retirement.

8. Review and update your insurance coverage

Make sure your insurance policies adequately cover your needs, including health insurance, life insurance, and long-term care insurance. Adequate coverage can prevent unexpected expenses from derailing your retirement plans.

9. Seek professional financial advice

Consulting a financial advisor can provide valuable insights and guidance tailored to your specific financial situation. They can help you optimize your retirement plan and make informed decisions about debt management.

10. Stay disciplined and adapt

Retirement planning is an ongoing process. Stay committed to your budget, savings goals, and debt repayment strategy. Be flexible and adapt to changes along the way to ensure a financially secure retirement.

Reviewing Insurance Coverage

When it comes to retirement planning, reviewing your insurance coverage is an essential step to protect yourself and your assets. Insurance policies play a crucial role in providing financial security during your retirement years. Here are some important aspects to consider:

1. Health Insurance

Ensure that you have a comprehensive health insurance plan that covers your medical expenses. As you age, healthcare costs tend to increase, so having adequate coverage is crucial.

2. Life Insurance

Review your life insurance policy to make sure it aligns with your retirement goals. Consider whether you still need coverage for your dependents or if you can reduce the coverage amount to save on premiums.

3. Long-Term Care Insurance

<

Long-term care insurance is often overlooked but can be vital in ensuring you are financially protected in case you need assistance with daily activities or nursing care as you age.

4. Property and Liability Insurance

Evaluate your property insurance to ensure it provides sufficient coverage for your home and assets. Additionally, review your liability insurance to protect yourself against potential lawsuits or claims during retirement.

5. Auto Insurance

If you plan on driving during retirement, review your auto insurance policy to make sure you have the appropriate coverage. Consider adjusting your coverage based on your driving habits and the value of your vehicle.

By reviewing your insurance coverage regularly, you can ensure that you are adequately protected during your retirement years. Consult with a financial advisor or insurance professional to discuss your specific needs and make any necessary adjustments to your policies.

Creating an Estate Plan

Planning for retirement is crucial, and one aspect that should not be overlooked is creating an estate plan. With an estate plan in place, you can ensure that your assets are distributed according to your wishes and minimize the burden on your loved ones. Here are 10 essential steps to consider when creating your estate plan:

- Take inventory of your assets: Start by making a list of all your assets, including property, investments, savings, and insurance policies.

- Set clear objectives: Determine your goals for your estate plan, such as providing for your family, minimizing taxes, or supporting charitable causes.

- Appoint an executor: Choose someone you trust to carry out your wishes and handle the distribution of your assets.

- Create a will: Draft a legally binding document that specifies how you want your assets to be distributed upon your death.

- Establish a power of attorney: Designate someone to make financial and legal decisions on your behalf if you become incapacitated.

- Consider a living trust: Explore the benefits of a living trust, which can help avoid probate and provide more control over asset distribution.

- Designate beneficiaries: Make sure you have named beneficiaries for your retirement accounts, life insurance policies, and other assets that allow beneficiary designations.

- Plan for incapacity: Prepare documents like a durable power of attorney for healthcare and living will to outline your preferences regarding medical treatment.

- Review and update regularly: Your estate plan should be reviewed periodically and updated to reflect any major life changes or new assets acquired.

- Consult with professionals: Seek advice from an estate planning attorney and financial advisor to ensure your estate plan is comprehensive and aligned with your goals.

By following these essential steps, you can create an estate plan that provides you with peace of mind and ensures your wishes will be fulfilled during retirement and beyond.

Conclusion

In conclusion, retirement planning is a crucial process that everyone should engage in to secure a comfortable and financially stable future. By following the 10 essential steps outlined in this article, individuals can take control of their retirement and ensure a stress-free transition into this phase of life.

Starting early, setting clear goals, and regularly reviewing and adjusting your retirement plan are key components of a successful retirement strategy. Additionally, maximizing savings, diversifying investments, and considering healthcare costs are important factors to consider when planning for retirement.