Financial freedom is a goal that many of us strive to achieve. It is the ability to have control over our finances, make smart financial decisions, and live a life free from financial stress. However, achieving financial freedom requires careful planning and goal setting. In this article, we will discuss five smart financial goals that can help you pave your way to financial freedom.

1. Establish an emergency fund: One of the first steps towards financial freedom is to establish an emergency fund. This fund should ideally be equivalent to 3-6 months of your monthly expenses. Having an emergency fund will provide you with a safety net in case of unexpected events such as job loss or medical emergencies.

Create a Monthly Budget

Having a monthly budget is crucial for achieving financial freedom. It allows you to track your income and expenses, identify areas where you can cut back, and save money for future goals. Follow these steps to create an effective monthly budget:

- Calculate your income: Start by determining your total monthly income from all sources, including your salary, side hustles, and any other additional income.

- List your expenses: Make a comprehensive list of all your monthly expenses. This should include essential expenses like rent/mortgage, utilities, groceries, transportation, and insurance. Don’t forget to account for variable expenses like entertainment and dining out.

- Categorize your expenses: Divide your expenses into different categories, such as fixed expenses, variable expenses, and discretionary expenses. This will help you prioritize where to allocate your money.

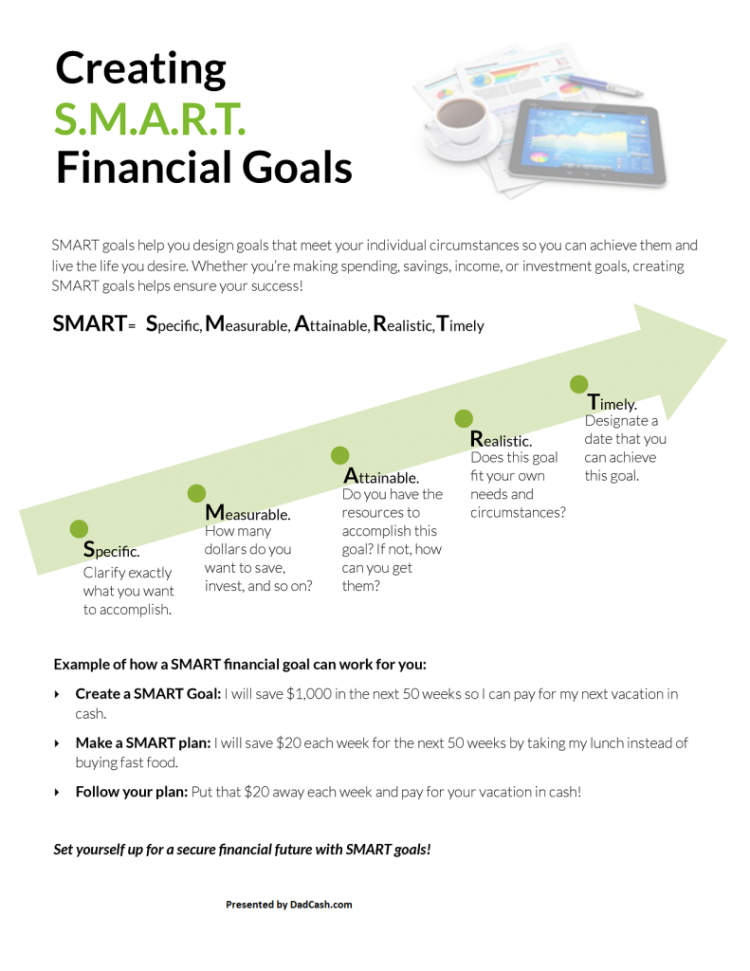

- Set financial goals: Determine what you want to achieve financially. It could be saving for a down payment on a house, paying off debt, or building an emergency fund. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Allocate your income: Assign your income to each expense category based on their priority. Remember to allocate a portion of your income for savings and investments.

- Track your spending: Monitor your expenses throughout the month to ensure you stay within your budget. Use budgeting apps or spreadsheets to help you track every penny.

- Review and adjust: Regularly review your budget to see if it’s working for you. If you realize that certain areas need adjustments, don’t hesitate to make changes and improve your budgeting strategy.

Creating and sticking to a monthly budget requires discipline and consistency, but it is a vital step toward achieving financial freedom. Start your journey to financial success today!

2. Pay Off Debt

Debt can be a major obstacle in achieving financial freedom. It can weigh you down and limit your options. However, with careful planning and dedication, you can pay off your debt and regain control over your financial situation. Here are some strategies to help you become debt-free:

Create a Budget

The first step in paying off debt is to create a budget. This will help you understand your income, expenses, and how much money you can allocate towards debt repayment. Identify areas where you can cut back on spending and redirect that money towards paying off your debts.

Prioritize Your Debts

Make a list of all your debts and prioritize them. Start by paying off high-interest debts first, as they cost you more in the long run. Set specific targets for each debt and focus on paying them off one by one.

Consider Debt Consolidation

If you have multiple debts with high interest rates, consider consolidating them into a single loan or credit card with a lower interest rate. This can make your debt more manageable and save you money on interest payments.

Increase Your Income

Look for ways to increase your income. You can take up a side job, start a freelance business, or explore new opportunities for career growth. The additional income can be used to accelerate your debt repayments and achieve financial freedom faster.

Negotiate with Creditors

Don’t hesitate to negotiate with your creditors for better repayment terms. Reach out to them and explain your financial situation. They may be willing to lower interest rates, waive fees, or work out a more affordable repayment plan for you.

Track Your Progress

Keep a close eye on your progress in paying off debt. Regularly update your budget, track your expenses, and monitor your debt balances. Celebrate small victories along the way and stay motivated to reach your ultimate goal of becoming debt-free.

By making a conscious effort to pay off your debt, you are taking a big step towards achieving financial freedom. Remember, it may take time and discipline, but the payoff is well worth the sacrifice. Take control of your finances and pave the way to a brighter and more secure future.

3. Save for Emergency Fund

Building an emergency fund is a crucial step in achieving financial freedom. Life is unpredictable, and unexpected expenses can arise at any time. By saving for emergencies, you can avoid going into debt or tapping into your long-term savings.

Here are some tips to help you save for your emergency fund:

- Set a savings goal: Determine how much you want to save for emergencies, such as three to six months’ worth of living expenses.

- Create a budget: Track your income and expenses to identify areas where you can cut back and allocate more funds towards your emergency fund.

- Automate savings: Set up an automatic transfer from your paycheck or checking account to a separate emergency fund account each month.

- Minimize unnecessary expenses: Evaluate your spending habits and reduce non-essential expenses to free up more money for your emergency fund.

- Start small, but be consistent: Even if you can only save a small amount each month, it’s important to be consistent and gradually increase your savings over time.

- Keep it separate: Designate a separate account for your emergency fund to avoid temptation of using the money for non-emergency purposes.

- Revisit and revise: Regularly review your emergency fund and adjust your savings plan as needed based on changes in your financial situation or goals.

By prioritizing the creation of an emergency fund, you can have peace of mind knowing that you’re prepared for unexpected financial challenges and are taking a proactive step towards financial freedom.

4. Invest for Retirement

When planning for your financial future, one of the most important goals to consider is investing for retirement. Investing in retirement accounts such as a 401(k), IRA, or Roth IRA can help you build a nest egg that will provide financial security in your golden years.

Here are some key reasons why investing for retirement should be a top priority:

- Long-term growth: By investing in retirement accounts, you can take advantage of compounding returns over time. The earlier you start investing, the greater your potential for long-term growth.

- Tax advantages: Retirement accounts often offer tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement. Maximize these benefits by contributing regularly and taking advantage of any employer matching programs.

- Protect against inflation: Investing in retirement assets, such as stocks or real estate, can help you stay ahead of inflation and maintain your purchasing power over time.

- Financial independence: By investing for retirement, you are taking proactive steps towards achieving financial independence. Having a substantial retirement fund can provide you with the freedom to pursue your passions and enjoy a comfortable lifestyle.

When investing for retirement, it’s essential to evaluate your risk tolerance, time horizon, and financial goals. Consider seeking the guidance of a financial advisor who can help you develop a personalized investment plan.

5 Set Long-Term Financial Goals

Setting long-term financial goals is essential for achieving financial freedom. By defining your objectives and creating a plan to reach them, you can take control of your financial future. Here are five smart financial goals to help you achieve financial freedom:

Save for Retirement

One of the most important long-term financial goals is saving for retirement. Start early and contribute regularly to a retirement account, such as a 401(k) or an Individual Retirement Account (IRA). Consider increasing your contributions whenever possible to maximize your savings.

Pay Off Debt

Debt can hinder your financial freedom. Set a goal to pay off any outstanding debts, such as credit card balances or student loans. Prioritize paying off high-interest debts first, and create a plan to gradually eliminate your debts over time.

Build an Emergency Fund

Having an emergency fund is crucial for financial security. Aim to save at least three to six months’ worth of living expenses in a separate savings account. This fund will provide a safety net during unexpected situations, such as job loss or major medical expenses.

Invest for the Future

Investing is an effective way to grow your wealth over time. Set a long-term goal to invest a portion of your income in a diversified portfolio of assets, such as stocks, bonds, or real estate. Consult with a financial advisor to determine the best investment strategy based on your risk tolerance and financial goals.

Plan for Major Expenses

Whether it’s buying a home, paying for your child’s education, or starting a business, major expenses often require substantial financial planning. Set a long-term goal to save and prepare for such expenses, considering factors like down payments, tuition fees, or start-up costs. Breaking down these goals into manageable steps will make achieving them more attainable.

By setting these long-term financial goals, you can pave the way to financial freedom. Remember to regularly review and adjust your goals as your circumstances change. With determination, discipline, and a well-thought-out plan, you can achieve financial freedom and enjoy a secure future.

Conclusion

In conclusion, setting smart financial goals is crucial for achieving financial freedom. By following these 5 smart financial goals, individuals can take control of their finances and work towards a secure and prosperous future.

Firstly, creating a budget and sticking to it allows individuals to track their income and expenses, making sure they spend wisely and save for the future. Secondly, paying off high-interest debt should be a priority as it frees up money that can be used for savings and investments. Thirdly, establishing an emergency fund provides a safety net during unexpected financial setbacks, reducing the need for borrowing money or relying on credit. Fourthly, investing for the long term helps individuals grow their wealth and secure a comfortable retirement. Lastly, continuously educating oneself about personal finance ensures that individuals make informed decisions and adapt to changing economic conditions.