Diversification is a vital strategy for investors looking to maximize their returns while minimizing their risks. By spreading investments across different asset classes, industries, and geographic regions, individuals can achieve a more balanced portfolio. The benefits of diversification extend beyond reducing the impact of market volatility and potential losses, and can also provide opportunities for long-term growth and increased potential for generating income.

One of the key advantages of diversification is its ability to mitigate risks. Investing solely in one company or one asset class can be risky as any negative development can significantly impact the portfolio’s value. However, by diversifying investments, individuals can reduce the exposure to any single investment, thereby protecting themselves from unexpected events. Additionally, diversification can help to smooth out the performance of a portfolio, as losses in one investment may be offset by gains in another, resulting in a more stable overall return over time.

The Importance of Diversification

Diversification is a crucial strategy in investment portfolios that offers numerous benefits. By diversifying your investments, you reduce the overall risk and increase the potential for long-term returns.

Here are some key reasons why diversification is important:

- Risk Management: Diversification helps to spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This reduces the risk of a significant loss in case one particular investment performs poorly.

- Maximize Returns: While diversification helps manage risk, it also allows you to maximize your returns. By investing in different sectors and industries, you can take advantage of various opportunities for growth and profitability.

- Stability: A well-diversified portfolio tends to be more stable and less volatile. When one investment goes through a downturn, others may perform well, minimizing the overall impact on your portfolio.

- Capital Preservation: Diversification helps protect your capital by reducing the impact of any single investment failure. By spreading your investments across different assets, you have a better chance of preserving your capital over the long term.

- Opportunity for Growth: By diversifying, you can tap into different investment vehicles that have the potential for growth. This includes both traditional assets like stocks and bonds, as well as alternative investments like real estate investment trusts (REITs) and exchange-traded funds (ETFs).

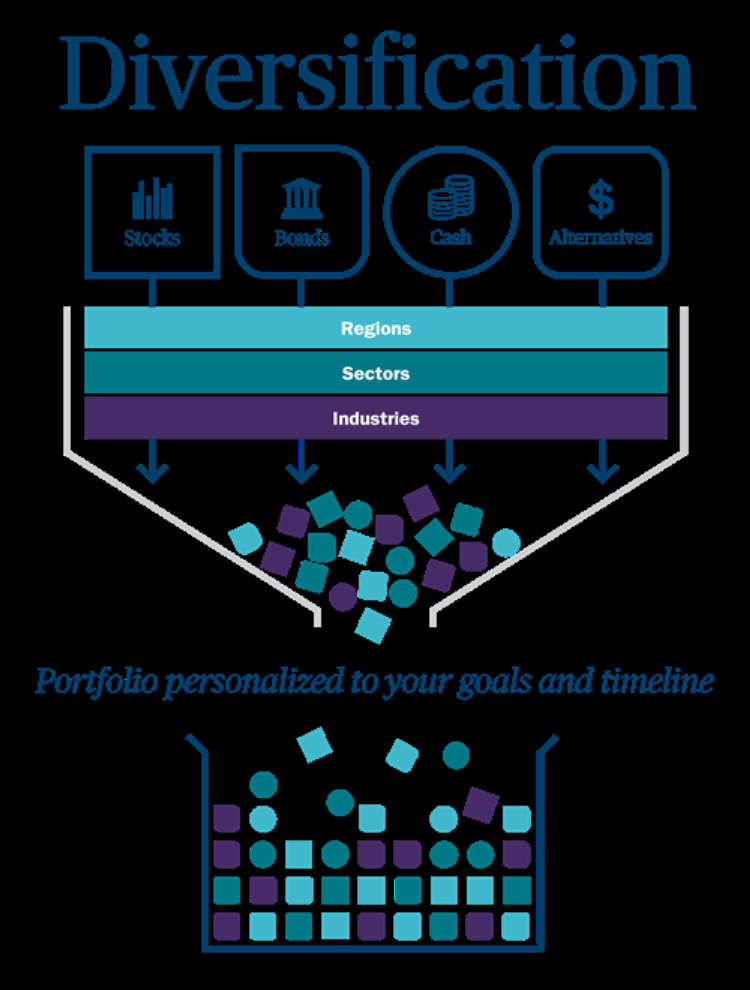

To achieve a well-diversified portfolio, it is essential to understand your risk appetite, investment goals, and time horizon. Diversification should be done across different investment types, geographic regions, and industries.

In conclusion, diversification is essential for any investment portfolio. It helps manage risk, maximize returns, provide stability, protect capital, and unlock opportunities for growth. By diversifying your investments, you can build a solid foundation for long-term financial success.

Reducing Investment Risk

When it comes to investing, one of the key goals is to minimize risk while maximizing returns. One effective strategy to achieve this is through diversification in investment portfolios. Diversification is the practice of spreading investments across different asset classes, industries, and geographical locations. By doing so, investors can reduce the impact of any single investment on the overall portfolio performance.

The Benefits of Diversification

Diversification brings several advantages that help in reducing investment risk:

- Minimizing exposure to single asset risk: By investing in a variety of assets such as stocks, bonds, real estate, and commodities, investors can avoid the risk of significant loss from any one asset class. This way, even if one investment performs poorly, others may compensate and mitigate the overall impact on the portfolio.

- Capitalizing on different market cycles: Different asset classes tend to have varying performance patterns over time. Allocating investments across these different asset classes can help investors benefit from the potential upsides in one area while dampening the downsides in another. This can enhance portfolio stability and reduce the overall risk level, especially during market volatility.

- Uncovering new opportunities: Diversifying investments also opens doors to new opportunities. By investing in various industries and geographical regions, investors can tap into emerging markets and sectors that have higher growth potential. This can potentially lead to higher returns and further diversify the investment portfolio.

- Reducing correlation: Correlation measures the relationship between different investments. A correlation value of +1 means two investments move in the same direction, while a value of -1 indicates they move inversely. By selecting investments with low or negative correlation, investors can reduce the overall portfolio volatility and increase the chances of achieving a consistent return.

In conclusion, diversification is an essential strategy for reducing investment risk. By spreading investments across various asset classes, industries, and geographical locations, investors can minimize exposure to single asset risk, capitalize on different market cycles, uncover new opportunities, and reduce correlation. Implementing diversification in investment portfolios provides a crucial safeguard against potential losses and can lead to more stable long-term returns.

Maximizing Returns

When it comes to investment portfolios, diversification is key. By spreading your investments across different asset classes, industries, and geographical regions, you can significantly increase your chances of maximizing returns. Let’s explore the benefits of diversification and how it can contribute to your investment success.

Diversification: Minimizing Risk

Diversification helps to mitigate risks associated with individual investments. By having a mix of stocks, bonds, real estate, and other assets in your portfolio, you spread out the risk of any single investment negatively impacting your overall returns. This way, even if one asset class underperforms, the others may still generate positive returns, balancing out your portfolio.

Increased Opportunities for Growth

By diversifying your investments, you open yourself up to a wider range of opportunities for growth. Different industries and regions experience growth at different times, so by having exposure to multiple sectors, you increase your chances of benefiting from economic trends. This can help you maximize your returns by taking advantage of high-performing stocks or emerging markets.

Protection Against Market Volatility

The financial markets are prone to volatility, with prices of investments fluctuating regularly. Diversification can act as a buffer against market volatility. If one asset class experiences a significant downturn, others may remain stable or even appreciate in value. This can help protect your portfolio from severe losses during market downturns.

Building a Well-Rounded Portfolio

Diversification allows you to build a well-rounded portfolio tailored to your goals and risk tolerance. By combining assets with different levels of risk and return potential, you can create a balanced investment strategy. This can help you achieve your financial objectives while managing risk effectively.

Conclusion

In summary, diversification plays a crucial role in maximizing returns in investment portfolios. It helps minimize risk, provides access to more growth opportunities, protects against market volatility, and allows you to create a well-rounded portfolio. By diversifying your investments, you can increase your chances of achieving long-term investment success.

Conclusion

Diversification is a key strategy that investors can employ to mitigate risks and maximize returns in their investment portfolios. By spreading investments across different asset classes, industries, and regions, investors can reduce their exposure to any single investment and balance out potential losses. This diversification not only helps to protect against market volatility but also increases the likelihood of achieving long-term financial goals.

One of the primary benefits of diversification is the reduction of risk. By investing in a variety of assets, investors can minimize the impact of negative events that may affect a specific asset or sector. For example, if an investor only holds stocks in one industry and that industry experiences a downturn, their entire portfolio could suffer significant losses. However, if the investor diversifies by allocating investments across different asset classes such as stocks, bonds, and real estate, the negative impact of one sector’s decline can be offset by the positive performance of others. This reduces the overall risk in the portfolio and provides a more stable investment journey.