Debt can often feel like a suffocating burden that holds us back from achieving our financial goals. Whether it’s credit card debt, student loans, or mortgage payments, being in debt can be financially and emotionally draining. However, there is a path to financial freedom – paying off debt. By creating a solid plan and committing to eliminating debt, individuals can attain a sense of financial security and open doors to a brighter future.

When it comes to paying off debt, the first step is to assess the situation. Take a close look at your financial landscape, including the total debt amount, interest rates, and monthly payments. This evaluation will help you prioritize which debts to tackle first. It’s crucial to be strategic in your approach and consider factors like high-interest rates and outstanding balances. Once you’ve established a plan, it’s time to take action by budgeting wisely, cutting unnecessary expenses, and allocating extra funds towards debt repayment. By staying committed to the process and monitoring progress along the way, you’ll steadily make your way towards financial freedom, leaving debt behind for good.

The Impact of Debt on Financial Freedom

Debt has a profound impact on one’s financial freedom. It can be a significant obstacle that prevents individuals from achieving their financial goals and living a life free from financial burdens. Understanding the consequences of debt is crucial in developing a strategy to pay it off and regain control over your finances.

Here are some ways in which debt affects financial freedom:

- High Interest Payments: When you have debt, a significant portion of your income goes towards paying interest, which hampers your ability to save, invest, or spend on other essential things.

- Impedes Wealth Creation: Debt limits your ability to build wealth. Instead of investing in assets that appreciate over time, you are stuck paying off liabilities. This situation keeps you from enjoying the benefits of compounding and accumulating wealth.

- Limits Financial Options: Having debt restricts your financial options. It becomes difficult to make important life choices such as starting a business, buying a house, or pursuing higher education, as lenders often hesitate to extend credit to individuals with high levels of debt.

- Increases Stress and Anxiety: Constantly worrying about debt can take a toll on your mental and emotional well-being. The stress and anxiety that come with financial troubles can impact other areas of your life, including relationships and overall happiness.

- Reduces Disposable Income: Debt payments eat up a significant portion of your income, leaving you with less disposable income for emergencies, leisure activities, or savings. This lack of financial flexibility can lead to a constant state of financial stress.

To achieve financial freedom, it is crucial to prioritize paying off debt. By developing a structured plan, reducing expenses, and increasing income, individuals can take control of their financial situation and work towards a debt-free future.

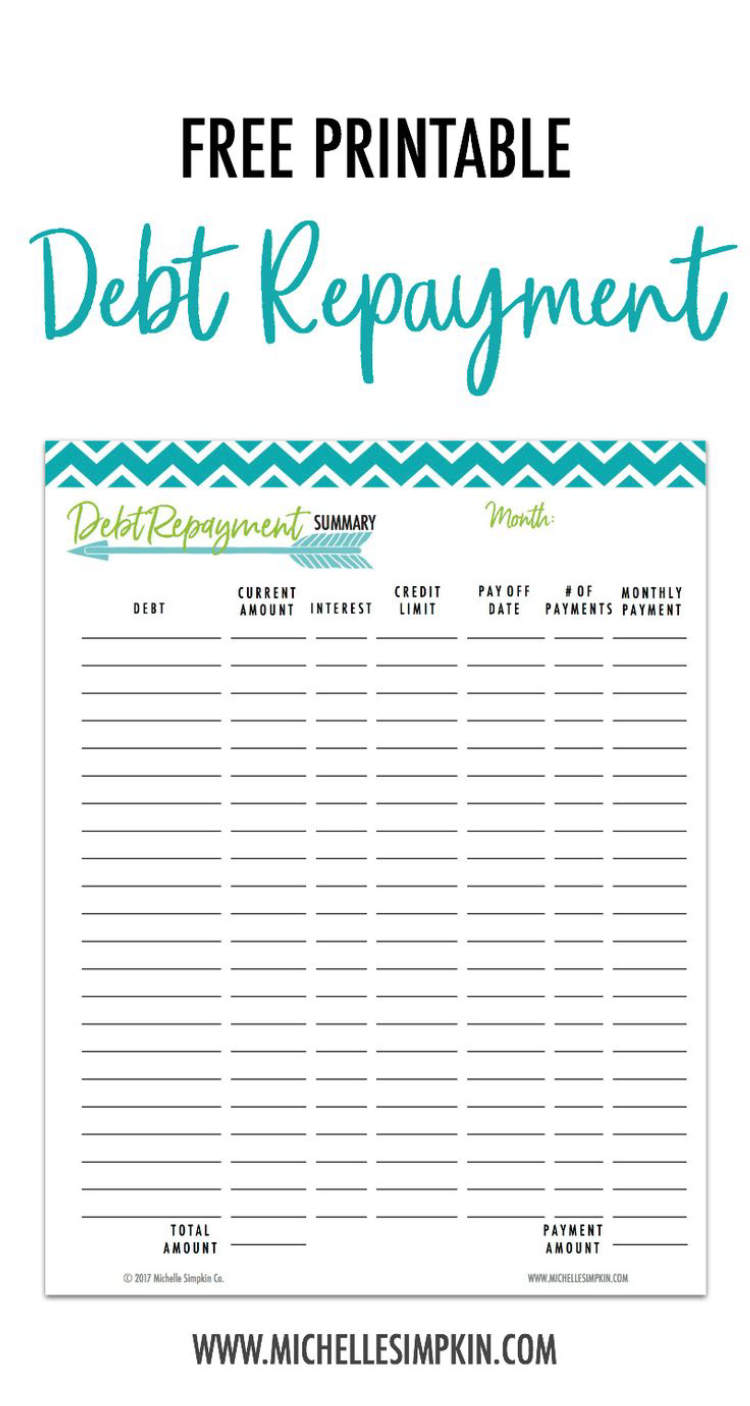

Creating a Debt Repayment Plan

Dealing with debt can be overwhelming, but by creating a well-thought-out debt repayment plan, you can take control of your finances and pave the way towards financial freedom. Whether you have credit card debt, student loans, or other financial obligations, here are some steps to help you create an effective debt repayment plan:

Evaluate and Prioritize Your Debts

The first step in creating a debt repayment plan is to assess and prioritize your debts. Make a list of all your outstanding debts, including the amount owed, interest rates, and minimum monthly payments. Consider focusing on debts with higher interest rates or those that are causing the most financial stress.

Set Financial Goals

Establishing clear financial goals is crucial when creating a debt repayment plan. Determine how much you can afford to allocate towards debt payments each month while still covering your essential expenses. Set specific targets, such as paying off a certain amount of debt within a given timeframe or becoming debt-free altogether.

Explore Debt Repayment Strategies

There are various debt repayment strategies you can adopt, depending on your financial situation and preferences. Two common approaches are the snowball method and the avalanche method. The snowball method involves paying off the smallest debts first, while the avalanche method focuses on tackling debts with the highest interest rates. Choose the strategy that aligns best with your goals and stick to it.

Create a Budget

To successfully repay your debts, it is essential to create a realistic budget. Track your income and expenses to identify areas where you can cut back and allocate more money towards debt payments. Make sure to prioritize debt repayment in your budget and avoid unnecessary expenses.

Consider Additional Income

If your current income is not sufficient to meet your debt payment goals, explore opportunities to increase your earnings. Consider taking on a side gig, freelancing, or selling unused items to generate extra income that can be used towards debt repayment.

Monitor and Adjust

Regularly monitor your progress and make adjustments to your debt repayment plan as needed. Keep track of your payments and celebrate milestones along the way. If you encounter unexpected financial challenges, don’t get discouraged; instead, reassess your plan and find alternative solutions.

Seek Professional Advice

If you are struggling with debt or finding it challenging to create a repayment plan on your own, consider seeking professional advice. Financial advisors or credit counseling services can provide valuable guidance and assist in developing a customized debt repayment strategy.

By following these steps and staying committed to your debt repayment plan, you can gradually eliminate your debts and achieve financial freedom. Remember, it may take time and discipline, but the rewards of becoming debt-free are well worth the effort.

Tips for Successfully Paying off Debt

Debt can be a burden that affects your financial well-being and overall quality of life. However, with the right strategies and a solid plan, you can successfully pay off your debt and work towards financial freedom. Here are some valuable tips to help you on your journey:

Create a Budget

Start by evaluating your income and expenses to create a realistic budget. This will help you see where your money is going and identify areas where you can cut back. Allocating a specific amount towards debt repayment each month will ensure steady progress.

Stop Accumulating New Debt

While paying off existing debt, it’s crucial to avoid accumulating more. Minimize your credit card usage and try to live within your means. Work towards building an emergency fund, so you won’t have to rely on credit cards in case of unexpected expenses.

Set Clear Debt Payoff Goals

Having specific goals will keep you motivated throughout your debt repayment journey. Start with small, achievable goals and gradually increase them as you make progress. Celebrate each milestone along the way to maintain a positive mindset.

Consider the Debt Snowball or Debt Avalanche Method

Two popular methods of debt repayment are the snowball and avalanche methods. With the snowball method, you prioritize paying off the smallest debt first, while with the avalanche method, you focus on the debt with the highest interest rate. Choose the method that suits your financial situation and preferences.

Explore Debt Consolidation or Refinancing Options

If you have multiple debts with high-interest rates, consider consolidating them into a single loan with a lower interest rate. Alternatively, explore refinancing options that can help you save on interest and simplify your repayment process.

Seek Professional Financial Advice

If you’re feeling overwhelmed or unsure about managing your debt, seeking advice from a financial professional can be beneficial. They can provide personalized guidance and help you create a customized debt repayment plan based on your circumstances.

Stay Committed and Stay Motivated

Paying off debt requires discipline and perseverance. Stay committed to your repayment plan even when it gets challenging. Remind yourself of the financial freedom you will achieve and the peace of mind that comes with being debt-free.

By implementing these tips and staying focused, you can successfully pay off your debt and pave the way towards financial freedom. Remember, it’s a journey, so be patient with yourself and celebrate every small victory along the way.

Conclusion

In conclusion, paying off debt is not an easy journey, but it is a crucial step towards achieving financial freedom. By prioritizing debt repayment, individuals can take control of their financial situation and pave their way to a better future. However, it is important to remember that paying off debt requires discipline, determination, and a solid plan.

By budgeting wisely, cutting unnecessary expenses, and increasing income streams, individuals can accelerate their debt repayment process. It is also essential to educate oneself about personal finance and seek professional advice when needed. Staying committed to the goal of becoming debt-free can bring long-term benefits, such as reduced stress, improved credit scores, and the ability to save and invest for the future. Ultimately, paying off debt not only provides financial freedom but also empowers individuals to live a fulfilling and secure life.