Keeping a tight budget can be challenging, but with the right strategies, you can make your money stretch further and achieve your financial goals. Whether you’re saving for a big purchase, paying off debt, or simply trying to make ends meet, these smart tips for budgeting on a tight budget will help you take control of your finances and make the most of every dollar.

One key step to successful budgeting is tracking your expenses. By keeping a detailed record of your income and expenses, you’ll be able to identify areas where you can cut back and save. Utilize online budgeting tools, apps, or even a simple spreadsheet to monitor your spending habits and categorize your expenses. This will provide you with a clear picture of where your money is going and allow you to make informed decisions about where to make adjustments.

Creating a Realistic Budget Plan

Having a budget plan is crucial to effectively manage your finances, especially when you are on a tight budget. By creating a realistic budget plan, you can prioritize your expenses, save money, and achieve your financial goals. Here are some smart tips to help you budget on a tight budget:

1. Analyze Your Income and Expenses

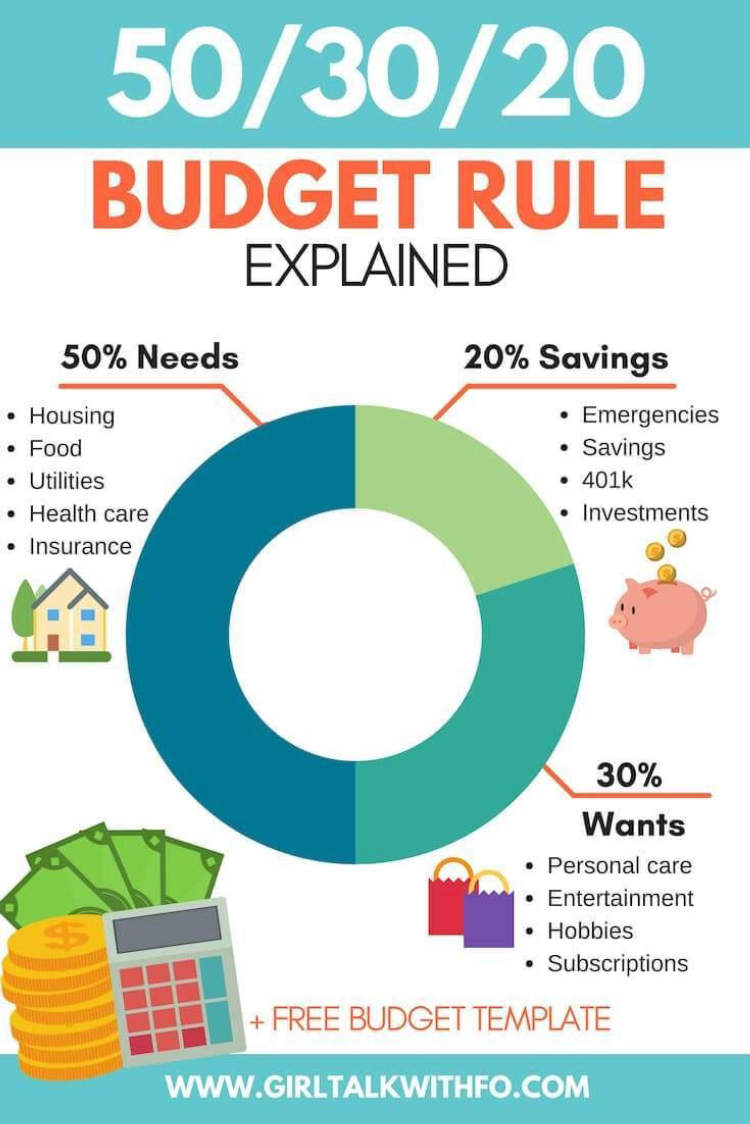

The first step is to carefully review your income and expenses. Calculate your monthly income and list down all your essential expenses such as rent, utilities, groceries, and transportation. Differentiate between needs and wants to identify areas where you can cut back.

2. Set Clear Financial Goals

Setting clear financial goals is essential to stay motivated and focused on your budgeting plan. Whether it’s paying off debt, saving for a vacation, or building an emergency fund, establishing concrete goals will help guide your budget decisions.

3. Allocate Money for Savings

Even on a tight budget, it’s crucial to allocate a portion of your income for savings. Aim to save at least 10% of your income each month. Consider automating your savings by setting up automatic transfers to a separate savings account.

4. Cut Back on Unnecessary Expenses

Identify areas in your budget where you can cut back on unnecessary expenses. This could include eating out less frequently, canceling unused subscriptions, or finding more affordable alternatives for certain products or services.

5. Track Your Spending

Maintain a record of your expenses to track your spending habits. There are numerous budgeting apps and tools available that can help you monitor your expenses and keep you accountable.

6. Use Cash Envelopes

Consider using a cash envelope system for certain categories of your budget, such as groceries or entertainment. Allocate a specific amount of cash for each category and only spend what’s available in the envelope.

7. Plan for Irregular Expenses

Don’t forget to include irregular expenses in your budget plan. These may include car maintenance, medical bills, or annual subscription fees. Set aside a small amount each month to cover these expenses when they arise.

8. Stay Flexible

Remember that your budget plan may need adjustments along the way. Be flexible and willing to adapt as needed. Life circumstances may change, and it’s important to revise your budget accordingly.

By following these smart budgeting tips, you can create a realistic budget plan even on a tight budget. Remember, the key is to be disciplined and consistent in your financial habits. With time and perseverance, you can achieve your financial goals and improve your overall financial well-being.

Maximizing Your Income

Discover the best strategies to boost your income and make the most of your budget.

1. Increase Your Earning Potential

Consider taking up a side gig or freelancing to supplement your primary income. Taking advantage of your skills and talents can open up new opportunities for earning.

2. Negotiate Your Salary

When starting a new job or during performance reviews, don’t be afraid to negotiate your salary. Research the market rate for your position and showcase your value to justify a higher pay.

3. Invest in Personal Development

Continuous learning and self-improvement can lead to career advancements and higher income. Invest in courses, certifications, or workshops that can enhance your skills and make you more marketable.

4. Explore Passive Income Streams

Investigate opportunities for passive income, such as rental properties, stocks, or monetizing a hobby. Diversifying your income sources can provide added financial security.

5. Leverage the Power of the Internet

Tap into the digital world to maximize your income. Start an online business, create and sell digital products, or become an influencer or affiliate marketer.

6. Optimize Your Income Tax Strategy

Consult with a tax professional to ensure you’re taking full advantage of all available deductions and tax credits. This can help you keep more money in your pocket throughout the year.

7. Reduce Expenses

While maximizing your income is crucial, it’s equally important to minimize your expenses. Scrutinize your budget and find areas where you can cut back on unnecessary expenses.

8. Prioritize Saving and Investing

Make saving and investing a priority. Set up automatic transfers to savings accounts and consider investing in retirement accounts or other investment vehicles that align with your financial goals.

9. Pay Off Debt Strategically

Create a plan to pay off your debts strategically, starting with high-interest debts first. This will free up more of your income in the long run.

10. Regularly Review Your Budget

Monitor and adjust your budget regularly to ensure it remains aligned with your financial goals and current circumstances.

Minimizing Expenses and Cutting Costs

In today’s challenging economic times, budgeting on a tight budget is crucial in order to make ends meet. By implementing these smart tips, you can successfully minimize expenses and cut costs to stretch your budget further.

1. Evaluate Your Spending Habits

The first step in budgeting is understanding where your money goes. Take some time to track your expenses and identify any unnecessary or excessive spending. This will give you a clear picture of areas where you can cut back.

2. Create a Realistic Budget

Once you have a better understanding of your spending habits, set specific financial goals and create a budget that reflects your income and expenses. Be realistic about your expenses and allocate funds to necessities such as rent, utilities, groceries, and transportation first.

3. Cut Down on Non-Essential Expenses

Identify non-essential expenses that you can reduce or eliminate completely. This may include dining out, entertainment subscriptions, unused gym memberships, or impulse shopping. Consider cheaper alternatives or find free activities to enjoy.

4. Minimize Utility Costs

Lower your utility bills by adopting energy-saving habits. Turn off lights, unplug electronic devices when not in use, adjust thermostat settings, and reduce water consumption. Additionally, consider comparing energy providers to ensure you’re getting the best rates.

5. Meal Planning and Grocery Shopping

Plan your meals in advance and create a grocery list based on your planned recipes. This will help you avoid unnecessary purchases and reduce food waste. Look for sales, coupons, and discounts while grocery shopping to save even more.

6. Embrace DIY

Instead of paying for services or products, consider doing them yourself. This could include home repairs, beauty treatments, or even making your own cleaning products. There are plenty of resources available online to guide you through various DIY projects.

7. Save on Transportation

Reduce transportation costs by exploring alternative commuting options. Carpool with colleagues or friends, use public transportation, bike, or walk whenever possible. This not only saves money but also benefits both your wallet and the environment.

8. Review Subscriptions and Memberships

Take a closer look at your monthly subscriptions and memberships. Cancel those that you no longer use or find cheaper alternatives. Streaming services, gym memberships, and magazine subscriptions are common areas where you might be able to cut costs.

9. Shop Mindfully

Before making any purchases, ask yourself if it’s a need or a want. Avoid impulse buying and compare prices from different retailers or online platforms. Take advantage of sales, discounts, and second-hand options to score great deals.

10. Seek Out Additional Income

If your budget is still tight even after implementing these tips, consider finding ways to increase your income. Look for part-time gigs, freelance opportunities, or explore your skills to start a small side business. Every extra dollar can make a difference in your budget.

Conclusion

In conclusion, budgeting on a tight budget may initially seem challenging, but with the right strategies and mindset, it is definitely achievable. By implementing smart tips such as tracking your expenses, prioritizing needs over wants, and finding creative ways to save money, you can effectively manage your finances even when funds are limited.

Remember, budgeting is not about depriving yourself of everything you enjoy, but rather making intentional choices that align with your financial goals. It requires discipline and commitment, but the rewards are well worth it. By practicing these smart budgeting tips, you can gain more control over your finances, reduce stress, and work towards a more secure and financially stable future.