Asset allocation plays a crucial role in building a strong investment portfolio. When it comes to investing, it is not just about selecting individual assets, but also about diversifying and distributing them effectively. By allocating your assets wisely, you can minimize risks and maximize returns.

One of the main reasons why asset allocation is important is because it allows investors to spread their investments across different asset classes such as stocks, bonds, real estate, and cash. Each asset class has its own risk and return characteristics, and by diversifying across these classes, investors can reduce the impact of any single asset’s poor performance on their overall portfolio. This diversification helps in creating a more stable and resilient investment strategy.

The Basics of Asset Allocation

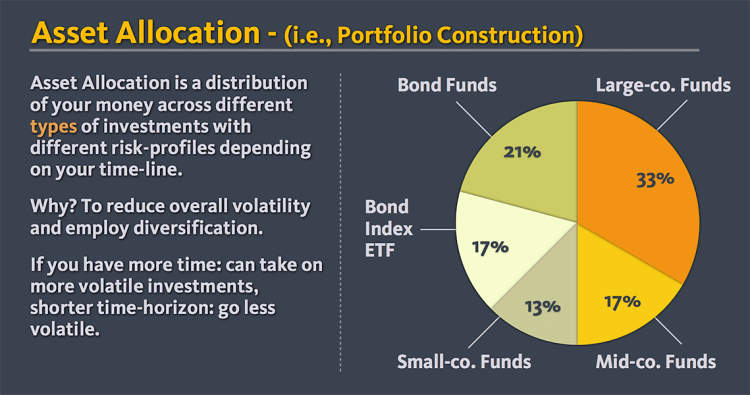

Asset allocation is a fundamental concept in the world of investing. It refers to the process of spreading your investments across different asset classes, such as stocks, bonds, and cash, to minimize risk and maximize returns. Here are some key points to understand about asset allocation:

1. Diversification: Asset allocation helps you diversify your portfolio by investing in different asset classes. This spreads your risk and reduces the impact of a single investment’s performance on your overall portfolio.

2. Risk and Return: Each asset class has its own level of risk and potential return. By allocating your assets across different classes, you can balance risk and return according to your investment goals and risk tolerance.

3. Time Horizon: Asset allocation also considers your investment time horizon. If you have a longer time horizon, you may be able to take on more risk and allocate a higher percentage of your portfolio to potentially higher-return investments, such as stocks.

4. Rebalancing: Over time, the performance of different asset classes can vary, causing your portfolio to deviate from your original asset allocation. Regularly rebalancing your portfolio ensures that it stays aligned with your target allocation.

5. Professional Help: Developing an effective asset allocation strategy can be challenging. Consider seeking the help of a financial advisor or investment professional who can provide guidance based on your specific circumstances and goals.

Benefits of Diversification

Diversification is a key strategy in building a strong investment portfolio. By spreading your investments across different asset classes, sectors, and regions, you can minimize risk and maximize returns. Here are some of the key benefits of diversification:

- Reduced Risk: Diversification helps to reduce the impact of any single investment on your overall portfolio. By investing in a mix of assets, you can offset potential losses in one area with gains in another, thereby reducing the overall risk.

- Enhanced Returns: Diversification not only helps to minimize risk, but it can also enhance returns. By investing in different asset classes, you can take advantage of varying market conditions and potentially earn higher returns than by focusing on a single investment.

- Increased Stability: A diversified portfolio is typically more stable and less volatile than one that is concentrated in a single asset class. This stability can help to protect your investments during periods of market turbulence.

- Capital Preservation: Diversification can help you preserve your capital by mitigating the risk of a major loss. Even if one investment performs poorly, the impact on your overall portfolio is likely to be minimal if you have diversified effectively.

- Access to Different Opportunities: By diversifying your investments, you gain exposure to a wider range of investment opportunities. This allows you to take advantage of growth in different sectors and regions, potentially enhancing your overall returns.

Overall, diversification is a powerful strategy that can help you manage risk, enhance returns, and build a strong investment portfolio. By carefully allocating your assets across different investment options, you can increase the chances of achieving your financial goals.

Strategies for an Effective Asset Allocation

When it comes to building a strong investment portfolio, one of the most crucial factors to consider is asset allocation. The way you distribute your investments across different asset classes can significantly impact the overall performance and risk level of your portfolio. Here are some strategies to help you achieve an effective asset allocation:

Diversify Across Asset Classes

Diversification is key to reducing investment risk. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can mitigate the impact of any one asset class underperforming. This strategy allows you to capture the potential upside of different sectors while minimizing the downside risks.

Consider Risk Tolerance and Time Horizon

Every investor has a unique risk tolerance and time horizon. It’s essential to evaluate your risk appetite and investment timeline before deciding on your asset allocation strategy. If you have a longer time horizon, you might be comfortable with a more aggressive allocation that includes a higher proportion of stocks. If you have a shorter time horizon or lower risk tolerance, you may opt for a more conservative allocation with a higher proportion of bonds or cash.

Regularly Rebalance Your Portfolio

Asset allocation is not a one-time decision. It requires periodic reviews and adjustments. As market conditions change, the performance of different asset classes may vary, causing your portfolio to deviate from your target allocation. Regularly rebalancing your portfolio ensures that you realign your investments to maintain the desired asset allocation and manage risk effectively.

Consider Investing in Index Funds or ETFs

If you are unsure about selecting individual securities within each asset class, opting for index funds or exchange-traded funds (ETFs) can be a smart move. These passive investment vehicles allow you to gain exposure to an entire asset class while diversifying risk. They often have lower expense ratios compared to actively managed funds, making them a cost-effective option for asset allocation.

Stay Informed and Seek Professional Advice

Asset allocation can be complex, and it’s important to stay informed about market trends and economic factors that may influence different asset classes. Consider reading financial news, attending investment seminars, or consulting with a financial advisor to gain insights and make informed decisions about your asset allocation strategy.

In conclusion, an effective asset allocation strategy is crucial for building a strong investment portfolio. By diversifying across asset classes, considering risk tolerance and time horizon, regularly rebalancing, exploring index funds or ETFs, and staying informed, you can optimize your portfolio’s performance while managing risk effectively.

Conclusion

In conclusion, asset allocation plays a crucial role in building a strong investment portfolio. It is the process of diversifying investments among different asset classes such as stocks, bonds, and cash to reduce risk and optimize returns. By spreading investments across various assets, investors can lower the impact of a single asset’s performance on their overall portfolio. This strategy helps to mitigate risk and increase the potential for long-term growth.

Furthermore, asset allocation enables investors to align their portfolios with their risk tolerance and investment goals. By carefully balancing different asset classes based on their expected risk and return characteristics, individuals can tailor their investment strategy to their specific needs. This approach allows them to manage risk effectively and take advantage of market opportunities while maintaining a long-term perspective.