In today’s fast-paced world, it is crucial to plan for your future and secure your financial well-being, especially when it comes to retirement. The importance of retirement savings cannot be emphasized enough, as it plays a significant role in ensuring a comfortable and stress-free life after years of hard work and dedication.

Retirement savings provide a safety net that allows you to maintain your desired lifestyle and enjoy the fruits of your labor during your golden years. It offers you the freedom to pursue your passions, explore new hobbies, travel, and spend quality time with your loved ones. Having a substantial nest egg not only provides financial security but also grants you peace of mind, knowing that your future is well taken care of.

The Benefits of Retirement Savings

Retirement savings is a crucial part of securing your financial future. By setting aside a portion of your income throughout your working years, you can enjoy several benefits when you retire.

1. Financial Security

Retirement savings provide you with the financial security you need during your retirement years. It allows you to maintain your desired lifestyle and cover expenses such as housing, healthcare, and daily living costs.

2. Freedom and Flexibility

Having a retirement savings plan gives you the freedom and flexibility to make important life choices. You can choose when to retire, where to live, and how to spend your time without relying solely on government pensions or social security benefits.

3. Compound Interest

One of the greatest advantages of starting retirement savings early is the power of compound interest. By investing your savings wisely, your money has the potential to grow exponentially over time, helping you accumulate a significant nest egg for the future.

4. Peace of Mind

Knowing that you have a solid retirement savings plan in place can bring you peace of mind. It relieves the stress and worry of relying solely on inadequate government or employer-provided retirement benefits, allowing you to enjoy your retirement years without financial concerns.

5. Tax Benefits

Retirement savings often come with tax benefits. Contributions made to retirement accounts such as 401(k)s or IRAs are often tax-deductible or may grow tax-free, allowing you to minimize your tax liability during your working years and maximize your savings.

6. Legacy for Loved Ones

By prioritizing retirement savings, you can also leave a financial legacy for your loved ones. Whether it is through a pension, life insurance, or investment accounts, having savings to pass down can provide security and support for your family even after you are gone.

Overall, the benefits of retirement savings are numerous and essential for a secure financial future. Start saving as early as possible, create a solid retirement plan, and seek professional advice to make the most of your savings journey.

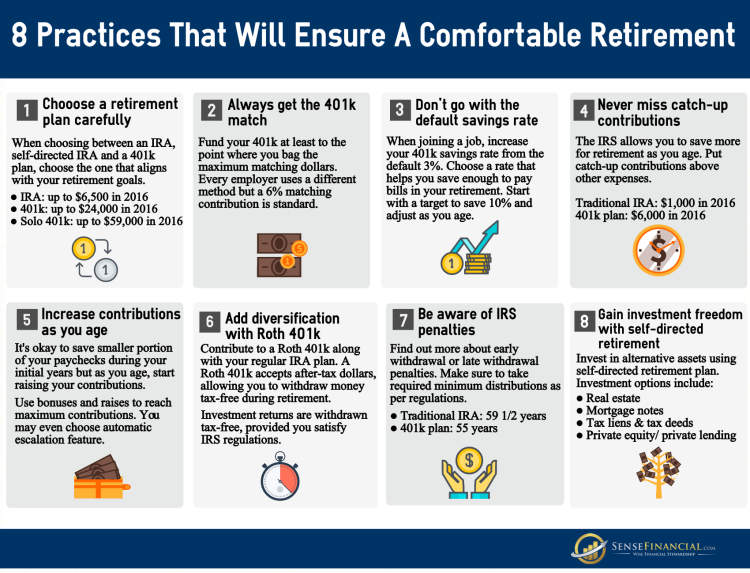

Strategies for Building a Strong Retirement Fund

When it comes to securing your financial future, building a strong retirement fund is crucial. With proper planning and smart strategies, you can ensure a comfortable retirement. Here are some effective strategies to help you build a solid retirement fund:

1. Start Early

One of the most important strategies for building a strong retirement fund is to start as early as possible. The power of compound interest works in your favor when you give your investments time to grow. The earlier you start saving for retirement, the more time your money has to compound and accumulate.

2. Set Clear Goals

Setting clear retirement goals is essential for effective financial planning. Determine the lifestyle you want to have during retirement and estimate the amount of money you will need. Having specific goals will help you stay focused and motivated to save.

3. Maximize Retirement Account Contributions

Take advantage of retirement accounts such as 401(k)s or IRAs (Individual Retirement Accounts). Contribute the maximum amount allowed by your employer or by law. These accounts offer tax advantages and can significantly boost your retirement savings.

4. Diversify Your Investments

Diversification is key to managing risk and maximizing returns. Spread your investments across different asset classes, such as stocks, bonds, and real estate. This helps minimize the impact of market fluctuations and increases the chances of earning higher returns.

5. Regularly Review and Adjust Your Plan

As you progress towards retirement, periodically review your retirement plan and make necessary adjustments. Consider factors like changing economic conditions, lifestyle changes, and investment performance. Stay informed and flexible to ensure your retirement fund remains on track.

6. Avoid Impulsive Spending

Avoid impulsive spending and unnecessary debt. Practice mindful financial habits and prioritize your retirement savings over non-essential expenses. Every dollar saved today can make a significant difference in your retirement fund in the long run.

By implementing these strategies, you can build a strong retirement fund and secure your financial future. Start early, set clear goals, maximize contributions, diversify investments, regularly review your plan, and avoid impulsive spending. Remember, the key is consistent saving and smart financial decisions.

The Potential Consequences of Neglecting Retirement Savings

Retirement may seem like a distant future, but neglecting to save for it can have severe consequences. As life expectancy continues to increase and the cost of living rises, it’s crucial to prioritize retirement savings early on. Failure to do so can result in financial hardships and limited options in your golden years.

Here are some potential consequences to consider if you neglect retirement savings:

- 1. Dependency on Social Security: Without sufficient savings, you may have to rely heavily on Social Security benefits during retirement. However, these benefits are often not enough to maintain the lifestyle you desire, and they may not even cover your basic living expenses.

- 2. Inadequate Funds for Healthcare: As you age, healthcare expenses tend to increase. Neglecting retirement savings can leave you financially unprepared to handle medical bills, long-term care costs, and unexpected health issues.

- 3. Limited Retirement Options: Without a substantial retirement nest egg, you may have to keep working well into your golden years or settle for a lower standard of living once you retire. Neglecting savings means sacrificing the freedom and flexibility to enjoy your retirement on your own terms.

- 4. Burden on Loved Ones: If you don’t have enough savings to support yourself during retirement, the burden may fall on your family members. This can strain relationships and create financial hardships for your loved ones as they try to support you.

Don’t let these potential consequences discourage you. Start saving for retirement now and take advantage of compound interest. The earlier you start, the more time your money will have to grow, and the better equipped you will be to face the future with financial security and peace of mind.

Conclusion

In conclusion, it is crucial to prioritize retirement savings for securing your financial future. As highlighted in this article, retirement is a phase of life that requires careful planning and preparation.

By starting early and consistently contributing to a retirement savings plan, individuals can take advantage of the power of compounding and ensure a comfortable retirement. It is important to be proactive and seek professional advice to find the right investment options that align with your risk tolerance and financial goals.