Annuities are a crucial aspect of financial planning that often goes overlooked. In this comprehensive guide, we will dive into the ins and outs of annuities, helping you understand how they can play a significant role in securing your financial future.

Whether you are just starting your career or approaching retirement, having a solid understanding of annuities is essential. This article will cover the basics of annuities, including different types, how they work, and the various benefits they offer. By the end, you’ll have the knowledge to make informed decisions and take control of your financial future.

What are Annuities?

Understanding Annuities: A Comprehensive Guide to Securing Your Financial Future

When it comes to planning for your financial future, it is essential to explore different investment options. One such option that often comes up is annuities. But what exactly are annuities and how do they work?

Annuities are financial products offered by insurance companies that provide a steady stream of income in the form of regular payments over a specific period of time. They are designed to help individuals secure their financial future by providing a reliable source of income during retirement or for a fixed period.

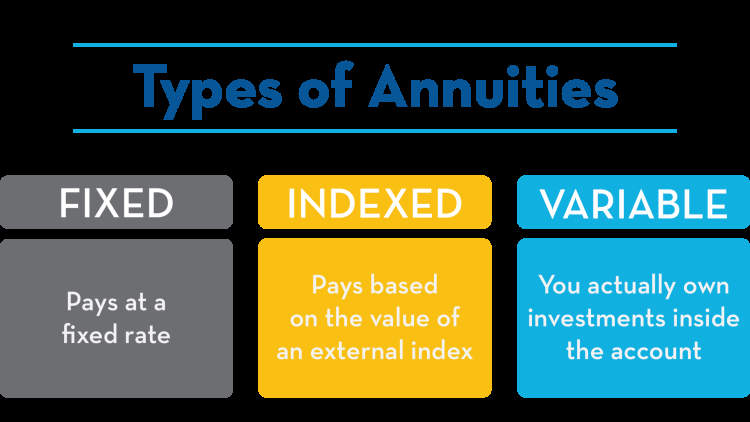

There are different types of annuities available, including:

- Immediate Annuities: As the name suggests, immediate annuities start providing income right away after a lump-sum payment is made. This type of annuity is suitable for those who want to start receiving payments immediately.

- Fixed Annuities: Fixed annuities offer a guaranteed fixed income for a specific period of time or for life. This can provide individuals with peace of mind, knowing exactly how much income they will receive.

- Variable Annuities: Variable annuities allow individuals to invest in various investment options, such as stocks and bonds. The income from these annuities depends on the performance of the underlying investments.

It is important to carefully consider your financial goals and risk tolerance when choosing the right annuity for you. Factors such as the payout period, surrender charges, and fees should also be taken into account.

Overall, annuities can be a valuable tool to secure your financial future, but it’s crucial to understand the terms, benefits, and potential drawbacks before making any decisions. This comprehensive guide aims to provide you with the necessary knowledge to make informed choices and ensure a secure financial future.

Types of Annuities

Annuities are financial products that provide a steady stream of income over a specific period of time. There are several different types of annuities available, each with its own features and benefits. Understanding the different types can help you make an informed decision about which annuity is right for you.

1. Fixed Annuities

Fixed annuities offer a guaranteed rate of return on your investment. The interest rate is fixed for a specific period of time, typically ranging from one to ten years. This type of annuity provides stability and security, as your principal is protected from market fluctuations.

2. Variable Annuities

Variable annuities allow you to invest your money in a selection of mutual funds or other investment options. The return on your investment is not guaranteed, as it depends on the performance of the underlying investments. This type of annuity offers the potential for higher returns but also carries more risk.

3. Indexed Annuities

Indexed annuities are tied to the performance of a specific stock market index, such as the S&P 500. They offer the opportunity to participate in market gains while also providing protection against market losses. Indexed annuities typically have a minimum guaranteed return, ensuring that you won’t lose your principal.

4. Immediate Annuities

Immediate annuities start paying you income shortly after you make your initial investment. This type of annuity is often used by retirees who want a steady stream of income in retirement. Payments can be guaranteed for a specific number of years or for the rest of your life.

5. Deferred Annuities

Deferred annuities provide a way to save money for retirement and delay receiving income until a later date. During the accumulation phase, your money grows tax-deferred, meaning you won’t pay taxes on the earnings until you start receiving payments. This type of annuity allows you to take advantage of compounding and potentially accumulate a larger retirement nest egg.

Understanding the different types of annuities can help you determine which option aligns with your financial goals and risk tolerance. It’s important to carefully consider your needs and consult with a financial advisor before making any decisions.

Benefits and Risks of Annuities

When it comes to securing your financial future, annuities can be a valuable tool. However, it’s important to understand both the benefits and risks associated with these financial products.

Benefits of Annuities

- Guaranteed Income: One of the primary advantages of annuities is the ability to receive a guaranteed income stream for a specified period or even for life.

- Tax-Deferred Growth: Annuities offer the advantage of tax-deferred growth, allowing your investment to grow without being subject to immediate taxes.

- Investment Options: With annuities, you can choose from various investment options to align with your risk tolerance and financial goals.

- Death Benefit: Many annuities come with a death benefit, ensuring that your beneficiaries receive a payout if you pass away before your annuity contract ends.

- Protection from Market Volatility: Fixed annuities provide stability and protection from market fluctuations, making them an attractive option for risk-averse investors.

Risks of Annuities

- High Fees: Some annuities can come with high fees and commissions, which can eat into your investment returns over time.

- Illiquidity: Annuities are generally considered long-term investments, and withdrawing funds before the contract term can result in surrender charges.

- Limited Access to Funds: Annuities often have restrictions on accessing your funds, limiting your liquidity and potentially affecting your ability to handle unforeseen financial emergencies.

- Complexity: Annuities can be complex financial products and require careful understanding of the terms and conditions, including potential penalties and surrender periods.

- Interest Rate Risk: For fixed annuities, there is a risk of losing potential higher returns if interest rates rise after you purchase the annuity.

Before considering an annuity, it is crucial to carefully evaluate your financial situation, goals, and risk tolerance. Consulting with a financial advisor can help you determine if annuities align with your overall investment strategy.

Conclusion

Annuities offer individuals a valuable tool for securing their financial future. By understanding how annuities work, the various types available, and the potential benefits and risks they present, individuals can make informed decisions about incorporating annuities into their overall financial plan.

While annuities can provide a steady stream of income during retirement, it’s important to carefully evaluate the terms and conditions of any annuity before making a commitment. Factors such as fees, surrender charges, and payout options should all be considered to ensure that the chosen annuity aligns with one’s specific financial goals and needs.