Investing can be a daunting task for many individuals who are looking to grow their wealth. While the idea of potentially earning substantial rewards may be enticing, it is crucial to understand the risks involved in the investment journey. In this article, we will delve into the world of investment risk, exploring both the rewards and pitfalls that investors may encounter.

Investment risk refers to the possibility of losing some or all of the invested capital due to various factors. These factors can include market volatility, economic downturns, company-specific issues, or unforeseen events. Understanding and managing these risks are essential for investors to make informed decisions and develop strategies that align with their financial goals. By analyzing the potential rewards and pitfalls of investing, individuals can navigate the investment landscape with confidence and increase their chances of achieving long-term success.

The Importance of Understanding Investment Risk

Investing can be a lucrative way to grow your wealth, but it is not without risks. It is crucial for investors to have a clear understanding of these risks before putting their money into any investment. By comprehending investment risk, individuals can make informed decisions and maximize their potential returns while minimizing the chances of significant losses. Here are some key reasons why understanding investment risk is essential:

1. Preserving Capital

One of the primary goals of investing is to protect and preserve capital. By understanding investment risk, investors can accurately assess the potential loss that they may face. This knowledge allows individuals to make calculated decisions and choose investments that align with their risk tolerance. It helps in avoiding excessive risks that may jeopardize the safety of their capital.

2. Setting Realistic Expectations

Investments come with various levels of risks and potential rewards. Understanding investment risk assists investors in setting realistic expectations about the returns they can anticipate. It prevents individuals from falling into the trap of unrealistic promises or expecting overly high returns without considering the associated risks. By having a clear understanding of investment risk, investors can make more informed judgments about the potential rewards their investments may bring.

3. Diversification Opportunities

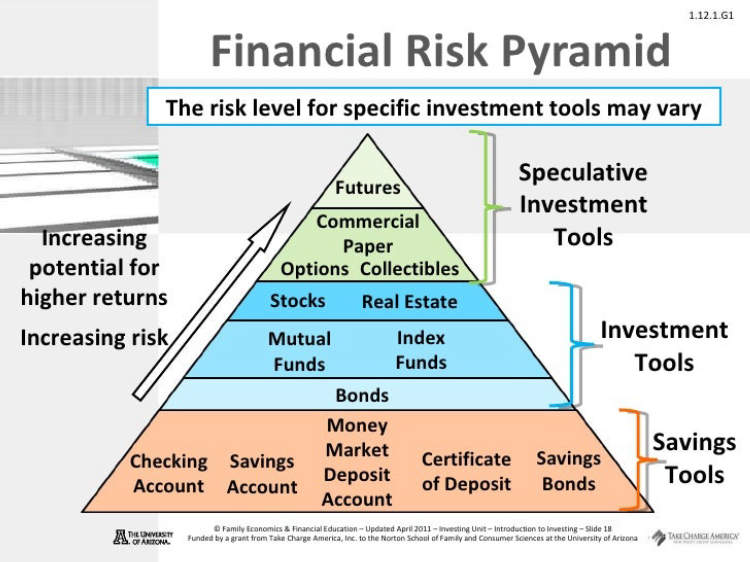

Investment risk can be managed through diversification. Diversifying a portfolio by investing in a variety of assets helps spread the risk and reduce the impact of any single investment’s poor performance. By understanding the different types of investment risk, investors can effectively allocate their resources across various asset classes, such as stocks, bonds, real estate, or commodities. Diversification not only helps to mitigate risk but also provides opportunities for potential growth.

4. Making Informed Decisions

Understanding investment risk empowers investors to make informed decisions. It allows individuals to evaluate the potential risks and rewards of different investment opportunities before making any financial commitment. By possessing a comprehensive understanding of investment risk factors such as market volatility, economic conditions, and industry-specific risks, investors can weigh the pros and cons of each investment and make choices that align with their financial goals and risk tolerance.

5. Minimizing Emotional Impact

Investing involves emotions such as fear and greed, which can influence decision-making. Understanding investment risk helps in keeping emotions in check by providing a rational framework for evaluating investments objectively. When investors have a strong grasp of investment risk, they are less likely to make impulsive decisions driven by short-term market fluctuations. This reduces the potential for emotional investing mistakes that may lead to significant losses.

In conclusion, understanding investment risk is of paramount importance for any investor. It helps preserve capital, set realistic expectations, seize diversification opportunities, make informed decisions, and minimize emotional impact. By acknowledging and analyzing investment risk factors, investors can enhance their chances of achieving long-term financial success.

The Potential Rewards of Investment

Investing your money wisely can offer numerous potential rewards. By understanding these rewards, you can make informed decisions and maximize your financial growth. Below are some notable benefits of investment:

- 1. Wealth Accumulation: Investment allows you to grow your wealth over time by earning returns on your initial capital. Various investment options, such as stocks, bonds, and real estate, can provide opportunities for capital appreciation.

- 2. Passive Income: Certain investments, like rental properties or dividend-paying stocks, can generate regular passive income. This additional income can supplement your primary source of earnings and improve your overall financial security.

- 3. Retirement Planning: Investing early in retirement accounts or pension plans can help you build a substantial nest egg for your future. By allowing your investments to compound over time, you can enjoy a comfortable retirement lifestyle.

- 4. Diversification: Investing across different asset classes and industries can help reduce the risk of losing all your money in a single investment. Diversification allows you to spread your risk and potentially increase your chances of earning positive returns.

- 5. Capital Preservation: While investing involves risks, certain investment options, such as government bonds or saving accounts, prioritize capital preservation. These investments can offer a low-risk way to protect your wealth while providing modest returns.

- 6. Increased Financial Knowledge: Engaging in investment activities exposes you to the dynamics of the financial markets. As you research different investment opportunities and analyze market trends, your financial knowledge and literacy will improve, which can benefit you in making better financial decisions.

Remember, investing always comes with risks, so it’s vital to carefully evaluate your investment options and seek professional advice if needed. The potential rewards mentioned above can vary depending on the market conditions and individual circumstances.

Pitfalls to Watch Out for in Investment

Investing can be a rewarding endeavor, but it is important to be aware of the potential pitfalls that can arise. Understanding and managing these risks is crucial to ensuring a successful investment journey. Here are some common pitfalls to watch out for:

1. Lack of Diversification: Putting all your eggs in one basket is a common mistake in investing. It is important to diversify your portfolio by investing in a variety of assets to reduce the risk of loss.

2. Market Volatility: The financial markets are volatile by nature, and prices can fluctuate significantly. It is important to be prepared for market ups and downs and not make impulsive investment decisions based on short-term market movements.

3. Overconfidence Bias: Overconfidence can lead to poor investment decisions. Be cautious about being overconfident in your abilities and ensure you do thorough research and analysis before making investment choices.

4. Lack of Patience: Investing is a long-term game, and success rarely comes overnight. It is important to have patience and not panic when faced with temporary market downturns. Stick to your investment plan and give your investments time to grow.

5. Ignoring Risk Management: Every investment carries some level of risk. Ignoring risk management strategies can lead to significant losses. It is crucial to assess and manage risks through techniques like stop-loss orders and proper asset allocation.

6. Emotional Investing: Letting emotions dictate investment decisions can be detrimental. Fear and greed can lead to impulsive buying or selling, causing investors to miss out on long-term gains or incur unnecessary losses.

7. Not Staying Informed: Staying updated with market trends and economic news is essential for making informed investment decisions. Failing to stay informed can leave you unaware of potential risks or opportunities.

8. High Fees and Costs: High fees and costs can eat into your investment returns significantly over time. It is important to consider the fees associated with investment products and choose options that offer a good balance between cost and potential returns.

By being mindful of these pitfalls and actively managing your investments, you can increase your chances of achieving your financial goals and minimizing potential setbacks.

Conclusion

Understanding investment risk is essential for anyone looking to grow their wealth through various investment opportunities. It is important to recognize that risk and reward go hand in hand. While higher risk investments may offer higher potential returns, they also come with the possibility of losing money. On the other hand, low-risk investments may provide stability but often offer lower returns.

Investors should carefully evaluate their risk tolerance before making any investment decisions. By considering factors such as their financial goals, time horizon, and future needs, individuals can determine the appropriate level of risk they are comfortable with. Diversification is another key strategy to mitigate investment risk. By spreading investments across different asset classes and sectors, investors can reduce the impact of any single investment’s performance on their overall portfolio.